INDIA – World’s Digital Economy Leader with “The India Stack”

“India’s Digital Infrastructure Worth Emulating by Many Nations: IMF Paper” – This was a headliner in many newsfeeds recently. This is based on a IMF working paper published during July, 2021

This IMF shoutout is another example of how India’s vision of last mile financial (and also non-financial) inclusion, technology prowess and soft power can not only benefit the world’s most populous and largest democratic country, but also serve as a replicable and reusable template for other countries worldwide.

As per Insider Intelligence report India is by far the world leader in digital payments with 46.8 billion real-time transactions in 2021 (which is estimated to have risen to 70 billion in 2022). China (18.5 billion), Thailand (9.7 billion), Brazil (8.7 billion), South Korea (7.4 billion), Nigeria (3.7 billion), UK (3.4 billion) and US (1.8 billion), round up the Top 10 in 2021.

I will attempt below to lay down the basic building blocks of The India Stack (and beyond), its mammoth scope and coverage, the benefits – all backed with data. Numbers do not lie!

What is “The India Stack”?

The India Stack is a comprehensive digital infrastructure built on a comprehensive digital identity, payment, and data-management system. The beauty of it has been that it took just about a decade to conceptualise and roll-out this “digital revolution” to more than a billion people in India.

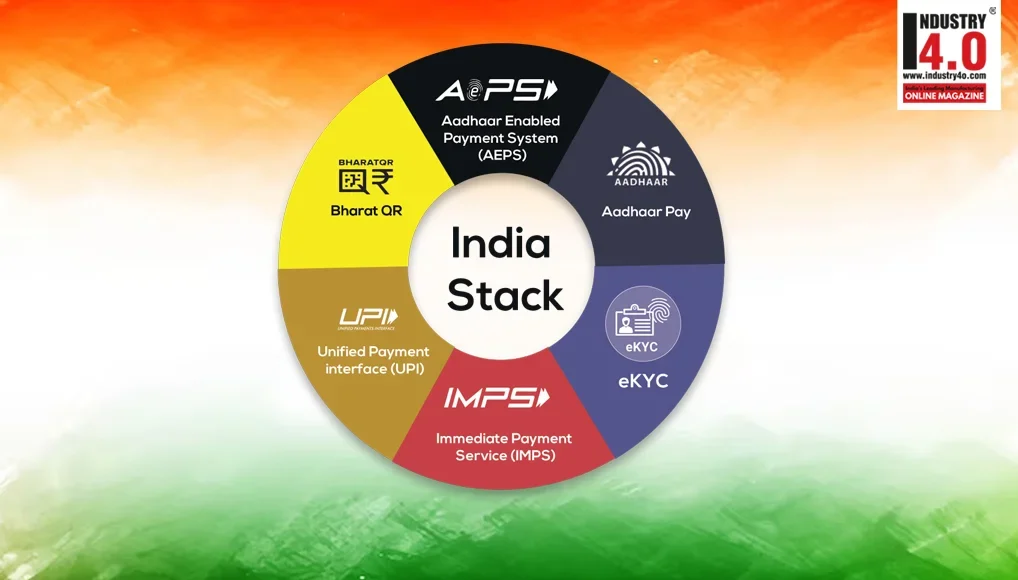

What are the components of this Stacks?

The India Stack foundationally covers the following layers:

Layer 1 – Digital Identification

The first step for this was to provide a unique biometric-based digital ID to every resident Indian citizen, which is basically the ubiquitous Aadhaar scheme. The UIADAI Portal (at the time of writing this article), showed 1,366,716,787 (equivalent to 1.367 billion) as total registered users in the enrollment dashboard. Considering the entire world’s population of 8.03 billion, this roughly translates to a whopping 17%.

The second step was to mandate linking bank accounts with Aadhaar. As per UIDAI data (June 2021), 86% of 140 crores (1.4 billion) bank accounts were seeded with Aadhaar. This number would have risen much more by now in April 2023. This is to ensure that targeted benefit transfers can be done seamlessly to intended beneficiaries.

The third step was the launch of the ambitious Pradhan Mantri Jan Dhan Yojana, as part of GOIs financial inclusion and development policy. There were primarily two objectives of this viz.,

a. Enlarging the imprint of the formal banking sector by including the unbanked poor and people in far-flung remote areas. In just one year, 166 million people had opened accounts as part of the program. This number had risen to almost 384 million by 2019, then to 478 million (as per GOI FM’s Budget speech on Feb 28, 2023) and now at 486 million (as on April 5, 2023). As per another IMF paper, similar expansions in financial access elsewhere have taken almost half a century!

b. Ensuring that government benefits (including subsidies) reach only the targeted people. The total number of benefit transfer transactions to Aadhaar linked bank accounts in India rose from 0.07 billion in May 2014 to 7.73 billion in March 2021, Using this digital infrastructure, India was able to quickly provide support to an impressive share of poor households during the COVID pandemic. In the first months of the pandemic about 87% of poor households received at least one benefit. Proof of the effectiveness of the JAM Trinity (Jan Dhan, Aadhaar & Mobile)!

The fourth step was to link PAN (Permanent Account Number) with Aadhaar. As per CBDT, more than 51 crore (0.51 billion) PANs have already been linked with Aadhaar till June 30, 2022. This is to ensure taxation related identifications, tracking and compliance.

Layer 2 – Interoperable Payments

While the first layer was more of Govt-to-Citizen (G2C) initiatives, this second layer involves the govt., citizens, and also private players like banks, NBFCs and fintech firms like digital wallets and mobile money. A new layer was introduced to the retail payment system, known as the Unified Payments Interface (UPI), whereby banks could exchange messages and payment orders with non-bank firms and also individuals.

This unleashed a digital payments eco-system revolution which mushroomed players like Paytm, PhonePe, Google Pay, Amazon Pay, etc. The GOI initiatives of BHIM UPI, BharatQR and RuPay Debit Cards (328.8 million issued till April 5, 2023), have further accelerated India’s move towards a digital economy. The RuPay payment gateway is also India’s alternative to the global duopoly of MasterCard and Visa credit cards.

An enabler for this has been the telecom revolution in India with a total of 1.10 billion cellular mobile connections active in India in early 2023, equivalent to about 77.5% of the total 1.42 billion population of India. Of these, there were 659 million smartphone users (2nd largest in the world), comprising 46.5% of the total population. The average mobile Internet download speed in India was recorded at 30.96 Mbps in February 2023, according to Ookla’s Speed test Global Index. India ranks 69 globally now in internet speed and is expected to significantly improve further with the ongoing nationwide 5G rollouts (and 6G in near future). Further, the mobile and internet data costs in India are amongst the lowest in the world.

Leveraging the banking sector inclusion initiative of Jan Dhan Yojana and the deep penetration of the telecom sector, it’s very rare now to find in India a street vendor or a small corner shop or a household service provider not using UPI. Digital payments are now ubiquitous across societal strata with UPI accounting for 68% of all payment transactions by volume.

These days dignitaries from Germany, US, ME and elsewhere laud India for leapfrogging the developed countries in the digital economy race, while lamenting they are lagging behind with cash and cheque-based transactions! Further evidence is borne out from the fact that Indian digital payment systems are available in Singapore, UAE, Oman, Saudi Arabia, Malaysia, France, Belgium, Netherlands, Luxembourg, Switzerland, among others. India has already signed MoUs with 13 countries that want to adopt the UPI interface for digital payments.

Layers 3 & 4 – Trust through consent

With “data being the new oil” (or if I may say “fuel of the digital economy”), the third “paperless layer” of the stack (DigiLocker) allows for verification of digital documents that can replace traditional paper equivalents, increasing efficiency and integrity. Apart from the financial sector, it’s usage can cover other sectors like Transport (e.g. storage and retrieval of car related documents for inspection), Education (e.g., Degree Certificates), Govt ID Proofs (Aadhaar, PAN, Voter ID, UAN, DL, Land Records, etc.) and many more.

The fourth and final layer of the India Stack (which is not yet fully operational) is Account Aggregator, formed of aggregators that intermediate the flow of financial data between individuals and financial firms. Roughly 4.5 million individuals and companies have benefited from easier access to financial services through the Account Aggregator, since it was first launched in August 2021, and adoption is increasing rapidly.

What are the Benefits?

- The India Stack is widening access to financial services in an economy where retail transactions are heavily cash based.

- Together they enable online, paperless, cashless, and privacy-respecting digital access to a variety of public and private service.

- Millions of people (across societal strata) in the formal and vast informal economy can now make & accept payments, settle invoices, and transfer funds anywhere in the country with just a few screen taps.

- Contactless digital payments for small transactions came as a boon as people try to protect themselves from the COVID virus.

- A digital ID card like Aadhaar dramatically lowers the cost of confirming people’s identities. These biometric checks reliably verify the identity of the holder, thus reducing the likelihood of false identities and fraudulent claims.

- Open-access and interoperable software standards facilitate digital payments between banks, fintech firms, and digital wallets.

- Access to people’s personal data is controlled through consent, thus ensuring data privacy.

- It has helped stabilize incomes in rural areas and boost sales for firms in the informal sector. The use of digital payments has expanded the customer base of smaller merchants, documented their cash flows and improved access to finances.

- Direct transfer of government benefits paid into the bank accounts, with people accessing the funds conveniently through RuPay/other debit cards or smartphones. It helped facilitate the transfer of social safety net payments directly from the government treasury’s accounts to beneficiaries’ bank accounts, helping to reduce leakages, curb corruption and providing a tool to effectively reach households to increase coverage.

- As per GOI estimates, from FY15 up to March 2021, a whopping INR 2.73 trillion (about 1.1 percent of GDP) in expenditure was saved by the direct beneficiary transfer (DBT) process enabled by The India Stack digital infrastructure and other governance reforms.

- Funds transfer can be done instantly to anyone if the recipient also has a digital wallet. Earlier transfers would take days or even weeks and would likely involve depositing cash at a distant bank branch/post office and paying hefty transfer fees.

- India Stack has been used as a platform to foster innovation and competition; expand markets; close gaps in financial inclusion; boost government revenue collection; and improve public expenditure efficiency.

- Digitalization has also supported formalization of the economy, as around 8.8 million new taxpayers registered for the GST between July 2017 and March 2022, contributing to buoyant government revenues in recent years.

- The India Stack has digitized and simplified Know Your Customer (KYC) procedures and lowered costs. Banks that use e-KYC lowered their cost of compliance from $12 to 6 cents. The decrease in costs made lower income clients more attractive to service and generated profits to develop new products.

Is there more to The India Stack?

A few other large-scale GOI initiatives that can be included to expand The India Stack story are:

1. Health Stack – In 2018, the GOI announced its plans to implement the National Digital Health Mission (NDHM). The National Health Stack (NHS) is a cloud-based service which will contain all of the data being used in the NDHM. It combines data from public health programs as well as socio-demographic data systems

and aims to “bring all the health verticals existing at the central and state govt. levels under one roof”. Further, in 2018, the Digital Information Security in Healthcare Act (DISHA) was drafted which aims to provide citizens with the rights to privacy, confidentiality, and security of their health data. The Health Stack has seen 2 big offshoots till date:

a. CoWIN – a COVID vaccine delivery and tracking platform. The total number of registrations shown in the CoWIN portal dashboard is 1,10,91,23,897 (while writing this article) with a total of 2,20,65,93,723 vaccination doses administered. India has also provided the technology underlying CoWIN to be deployed in Indonesia, Philippines, Sri Lanka and Jamaica to help facilitate their own vaccination programs.

b. ABHA (Ayushman Bharat Health Account) – ABHA is a unique health ID that uses a 14-digit identification number and can be generated using an Aadhaar card or your mobile number. It allows users to share their health records digitally with hospitals, clinics, insurance providers and others. Citizens can create their unique ABHA without any cost. Till 15th July 2022, a total of 22,97,64,327 ABHA numbers had been created.

2. Agri Stack – The goal of the Agri Stack is to provide a large scale database of farmers’ information, including a unique digital ID for farmers, with data regarding land profiling and other data points including the 11.5 crore landholding farmers who have availed schemes like PM KISAN.

3. Edu Stack – The GOI has been supporting to boost the Edtech industry through various initiatives such as SWAYAM (study webs of active learning for young aspiring minds), Diksha, e-Pathshala, and NIOS (National Institute of Open Schooling). In addition to this, the government of India has also introduced the National Education Policy (NEP) in 2020. Apart from provisions specific to the schooling system, there is also a push towards innovating education using technology. Edtech solutions will be used to support various skill-building programs as well, which are proposed by the NEP. It is also envisioned that there will be a set of APIs under India Stack for the education sector (iSPIRIT).

4. Digital Commerce – Open Network for Digital Commerce (ONDC) is a network based on open protocol and will enable local commerce across segments, such as mobility, grocery, food order and delivery, hotel booking and travel, among others, to be discovered and engaged by any network-enabled application.

Click here for more details on the above

The proof of the pudding is in the eating! India has showcased that with clear-sighted vision, decisive leadership and leveraging technology, how The India Stack has made India the digital economy leader of the world.

Also that, India is happy to share this secret sauce with the rest of the world, as it truly believes in “One World, One Family”.

Banner Image credit : Senrysa

Disclaimer: The contents of this article are purely written in an individual capacity with data available in the public domain and based on the personal opinions of the author. Data sources and image credits have been cited duly as and where applicable.

About the Author :

Mr. Subham Sarkar is an experienced senior management professional in the IT services realm with a flair and good understanding of the macro economics and dynamics of the world economy, how the ever evolving technology landscape is opening up newer possibilities for both enterprises and consumers, key business drivers of various industry types – and how all these can be assimilated to conceptualise an executable strategy for the growth of an IT services organisation, and also incubating and executing on these with the various stakeholders and teams.

Mr. Subham Sarkar core basic objective is to be known and respected as a professional and a good human being in his sphere of influence – one who continuously strives for excellence, while contributing meaningfully to his profession, to the society he live in and most importantly his family.

Mr. Subham Sarkar is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/su

Mr. Subham Sarkar can be Contacted at :

Mobile : +91-81476 52280

Also read Mr. Subham Sarkar‘s earlier articles: