Managing Third-party Cyber Risks in the Digital Banking Sector

In the context of growing digital space and emerging technology, cybersecurity is vital and third-party risk is one of the growing threats in an organization. Cybersecurity incidents and data breaches are increasing across vendors, suppliers, and other businesses not limiting to the bank. In a digitally interconnected world, the cybersecurity strength of any organization is not measured by its own defense controls but by the weakest link in the third-party sources. Hence, digital banks need to consider their third parties cybersecurity posture to an equal degree as their own to build business resilience.

Although the banking sectors work hard on keeping their ecosystem strong, it doesn’t make or take cautious efforts to eliminate third-party risks. Often the third parties are not very vigilant about their own security which could, in turn, be putting an organization at risk of cybersecurity attacks, where substantial costs and reputational damage is involved. The importance of managing third-party risk cannot be overstated in the ever-evolving banking sector landscape. Banks rely on external vendors, suppliers, and service providers to enhance efficiency, cut costs, and offer a broader range of services. However, this dependency also exposes them to a myriad of risks.

Although the banking sectors work hard on keeping their ecosystem strong, it doesn’t make or take cautious efforts to eliminate third-party risks. Often the third parties are not very vigilant about their own security which could, in turn, be putting an organization at risk of cybersecurity attacks, where substantial costs and reputational damage is involved. The importance of managing third-party risk cannot be overstated in the ever-evolving banking sector landscape. Banks rely on external vendors, suppliers, and service providers to enhance efficiency, cut costs, and offer a broader range of services. However, this dependency also exposes them to a myriad of risks.

This article delves on the challenges, strategies, and best practices for effectively managing third-party cyber risks in the banking sector with deeper study for a clear understanding. Working with third parties is primarily challenging but a necessary part of the business globally. So, it’s very important for the banks to make sure that the third party they are engaging with are secure, developed, and reliable to establish a connection. Third-party cyber risk is evolving day by day increasing the risk of leaving third party cybersecurity unaddressed. It primarily focuses on identifying, analyzing, and minimizing risks relating to cyber threats/data breaches. Many have faced cybersecurity attacks, phishing attacks, malware, data breaches and other cybercrimes majorly involving their third-party partners. To mitigate the cyber risks posed by third parties, banks need to take a proactive approach to build a robust cybersecurity posture that covers everything from end-to-end to protect the vendor environment.

If business resilience is the primary objective of the digital bank, it should take precautionary measures on its standards, its approach, processes, and metrics across different third parties to reduce cyber risks and increase the third-party risk resilience. For building a robust cybersecurity culture and implement security standards in a third-party environment, it is important to understand the prevailing risks and challenges associated with third parties.

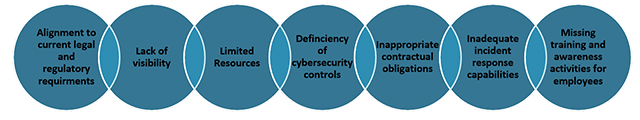

Key challenges in the Third-Party Environment :

As the banks are evolving day by day in this digital world and adapting to changing technologies, it’s very important to have clear and concise policies/procedures that outlines the organization’s needs & expectations from the third-party service providers to mitigate the risks associated with regulatory uncertainty or in defending any cyber threats that may arise. The biggest challenge in enforcing end-to-end cybersecurity governance in a third-party environment are :

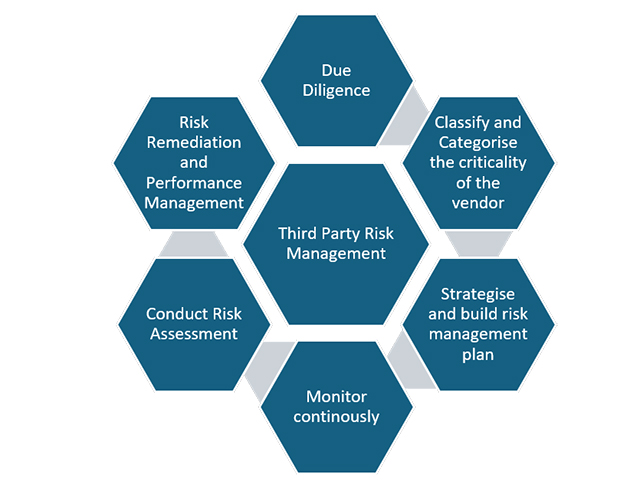

Usually, banks have a structured protocols to enforce the cybersecurity culture across inhouse business functions using their enterprise policies, procedures, and guidelines, but, when it comes to third parties, banks don’t have controls over their security standards and struggle to embed their cybersecurity culture. The main principle of third-party risk management is very clear and simple, if you’re not able to control it, you will not be able to secure it. This includes everything from identifying the right set of vendors, categorizing them, defining contractual obligations with clear visibility, conducting vendor risk assessments, mitigating the risks, continuous monitoring and implementing end-to-end encryption.

Best Practices to manage Cybersecurity and Data Protection Third Party Risks :

For managing third-party cyber risks, banks should take a proactive approach to define various business requirements, build business relationships, and risk factors for building a robust cybersecurity culture. Based on the size and criticality of the vendor, banks need to work on third-party risks to evaluate and do an in-depth assessment to understand the current maturity levels. Few important factors while doing an assessment are the regions where the vendor operates, spread of the vendor employees, practicing tools and technologies, their cloud strategies, ISO status, back up plans during a cyber incident/data breach, the insurances leveraged by the third party and incident response levels.

Overall compliance with regulatory requirements is non-negotiable in the banking sector. It’s very important to ensure the security controls within the organization and with their third parties are robust to face the emerging threats in this digital space. Failure to comply with legal and regulatory requirements can lead to substantial fines and reputational damage.

Managing third-party cyber risks in the banking sector is an ongoing process that requires a proactive approach to stay resilient in nature. By following best practices and adhering to legal & regulatory requirements, the banking sector can build a cyber-resilient environment to protect itself against the evolving third-party cyber risks.

About the Author :

Ms. Kavitha Srinivasulu

Global Head – Cyber Risk & Data Privacy – R&C BFSI

CCISO | DPO | CISM | CEH | CCSO | CCIO| PCSM | PDPP |

Ms. Kavitha Srinivasulu has around 20+ years of experience focused on Cybersecurity, Data Privacy & Business Resilience across BFSI, Financial services, Retail, Manufacturing, Health care, IT Services and Telecom domains. She has demonstrated her core expertise in Risk Advisory, Business Consulting and Delivery assurance with diverse experience across corporate and Strategic Partners.She is a natural leader with versatility to negotiate and influence at all levels.

Ms. Kavitha Srinivasulu is a Board Member of Women in CyberSecurity (WiCyS) India

Ms. Kavitha Srinivasulu is an Executive Committee Member CyberEdBoard Community

Ms. Kavitha Srinivasulu is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/ka

https://www.linkedin.com/in/ka

Ms. Kavitha Srinivasulu can be contacted at :

LinkedIn : https://www.linkedin.com/in/ka

Also read Ms. Kavitha’s earlier article: