FINTECH / BFSI Trends in 2024 & Beyond..

The Banking and Finance industry is one of the industry which is continuously evolving over the years and one of the fastest to adopt the technology to advance its reach and usage. In the past few years, line is slowly getting blurred between technology company and banks.

In the 21st century, businesses are no longer confined to implementing old-school or traditional ways, credit to the FinTech revolution! FinTech is known for its cutting-edge technologies of AI and blockchain. Lot of FinTech are growing at an exponential rate and giving tough competition to established institutions.

Every year, new innovations are taking BFSI industry to new heights and to a wider reach. Several central banks are launching CBDC while banning cryptocurrencies, it is yet to reach the critical mass adoption. Several countries have launched Crypto ATM however its usage is limited to only miniscule tech0savvy banking population.

Bank and state governments are exploring the usage of blockchain for record maintenance and other relevant use-cases. The widespread use of blockchain in Trade finance, cross-border payments, asset tokenization, KYC and settlement and clearing is visible.

Hyper-personalization is buzz-word for quite some time, but the customer is yet to get a feel of it and may become mainstream in coming years. Account aggregators are ‘IN’ thing and trying to compete with native apps. Super Apps are also another ‘Universal domain’ which banks are trying to build in a single mobile app and also attempting customer to use it.

Here, are some trends that will be noticed in 2024 and beyond:

1. Embedded Finance

Embedded finance seamlessly integrates financial services into non-financial platforms, enabling businesses in e-commerce, tech, or retail to offer financial products without direct interaction with a bank. For example, Shopify provides embedded financial services through Shopify Capital, streamlining the loan process for merchants based on their sales history. This allows businesses to access funding without traditional banking channels.

The popularity of Buy Now, Pay Later (BNPL) services in e-commerce platforms exemplifies embedded finance. Companies like Afterpay and Klarna seamlessly integrate installment payment options at checkout, aligning with users’ financial preferences.

Transportation is another sector adopting embedded finance. Ride-hailing apps like Uber integrate payment functionalities directly into their apps, providing a hassle-free experience for users to pay without cash or switching platforms.

The future of embedded finance holds great potential. With the proliferation of Internet of Things (IoT) devices, we may see embedded insurance where policies are automatically activated for specific products or services. The integration of embedded finance across various sectors enhances convenience, efficiency, and accessibility, revolutionizing the way businesses and consumers engage with financial products and services.

2. AL/ML in financial services

AI (GenAI) and ML are being extensively used in the banking and financial services industry, bringing numerous benefits and transforming various aspects of the sector. In coming days, AI/ML will not only help in taking informed investment decisions using robo-advisor, provide hyper-personalized portfolio management services and improve customer experience with AI-chatbots, but it will also be widely adopted in the following areas:

1. Reduction in operational costs and risk: AI and ML algorithms can automate manual processes, leading to cost savings and increased efficiency. They also help identify and mitigate potential risks by analyzing large volumes of data.

2. Financial monitoring and risk management: AI and ML models can analyze vast amounts of financial data in real-time, detecting anomalies and potential fraud. These technologies help banks and financial institutions in monitoring transactions, identifying suspicious activities, and managing risks effectively.

3. Regulatory compliance: AI and ML play a crucial role in assisting banks and financial institutions in meeting regulatory requirements. These technologies can analyze vast quantities of data to ensure adherence to compliance standards and detect any potential violations.

4. Fraud prevention: AI and ML models are employed to identify patterns and anomalies that indicate fraudulent activities. These technologies help in detecting and preventing financial fraud, protecting both customers and institutions.

Overall, AI and ML are revolutionizing the banking and financial services industry by improving operational efficiency, enhancing customer experiences, managing risks, and enabling data-driven decision-making.

3. AL/ML in Insurance services

AI and ML are revolutionizing the insurance industry by transforming various aspects of insurance services.

Here are some ways AI and ML are utilized and will see widespread adoption in coming year:

1. Risk assessment and underwriting: AI and ML algorithms analyze vast amounts of data to assess risks accurately and streamline the underwriting process. They help insurers make informed decisions by identifying patterns, correlations, and trends in historical data specific to the insurance domain.

2. Fraud detection and prevention: AI-powered technologies enable insurers to detect and prevent fraud by analyzing large volumes of data. These technologies can identify suspicious patterns, anomalies, and potential fraudulent activities, saving insurers significant costs.

3. Claims processing and automation: AI and ML algorithms automate claims processing, reducing the need for manual intervention. These technologies can extract relevant information from documents, analyze images, and predict claim outcomes, improving efficiency and accuracy.

4. Customer experience and personalization: AI-driven chatbots and virtual assistants provide personalized Customer experiences by answering queries, assisting with policy selection, and guiding customers through the insurance process. AI also helps insurers offer personalized recommendations and policies tailored to individual needs.

5. Predictive analytics and pricing: AI and ML models enable insurers to predict customer behavior using embedded IoT, calculate risk profiles, and refine pricing strategies, particularly for Auto-insurance. These technologies leverage data analysis to determine optimal coverage and premium rates for customers. Telematics and applications monitor real-time behavior, allowing adjustments in premiums based on driving habits. Acko, Progressive and Allstate determine premiums based on actual driving habits. Metromile’s pay-per-mile insurance benefits low-mileage drivers with dynamic pricing.

6. Loss prevention and risk management: AI-powered systems can analyze data from various sources, such as IoT devices, to monitor risks and identify potential hazards. Insurers can proactively mitigate risks, prevent losses, and offer risk management solutions to customers.

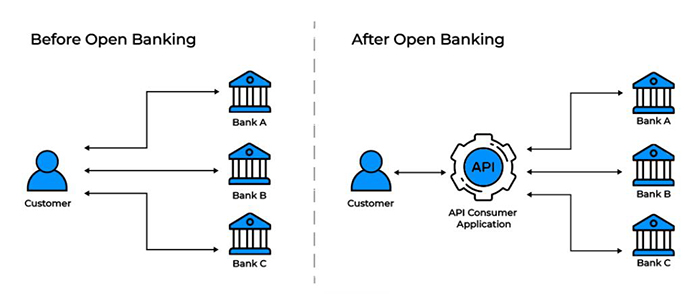

4. Open banking Platforms

Open Banking is a transformative practice that redefines the payment landscape by granting authorized third-party providers (TPPs) access to a customer’s banking data through secure application programming interfaces (APIs). This access is only permitted with explicit consent from the customer, giving them full control over their data-sharing preferences. This is leading to a surge in account-to-account (A2A) payments empowering customers to wield greater control over their financial data while unlocking a plethora of cutting-edge financial services apps.

Some of the top open banking platform providers are Mambu (cloud banking platform), Plaid (12k financial institutions), Tink (6000 integrations, 1BN API calls per month), Stripe, Token and True Layer.

The TPPs on behalf of bank customers offer two primary services: Account Information Services (AIS) that enables customers to access and consolidate information such as account balances and transaction history from all their bank accounts in one centralized platform. Payment Initiation Services (PIS) that helps customers to make online payments seamlessly without the need to manually input credit card details. Instead, they authorize secure payment transactions directly from their bank accounts.

Overall, open banking empowers customers with greater convenience, enhanced security, and control over their financial data, making it a game-changer in the payment landscape. Open Banking is already present and continues to evolve actively in coming years.

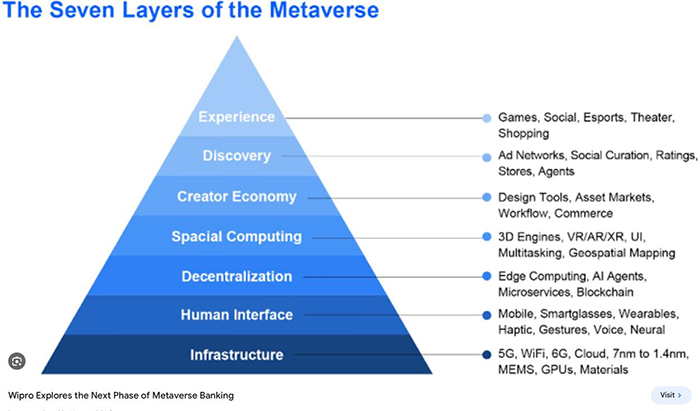

5. Metaverse banking

JPMorgan has become the first bank to establish a presence in the metaverse by opening a lounge in Decentraland, a blockchain-based virtual world. Users can create virtual avatars, explore the lounge, and access Ethereum-based services. This move highlights the growing trend of banks venturing into the metaverse to provide customers with immersive digital experiences.

In India, several banks have also launched their virtual branches in the metaverse. Punjab National Bank (PNB) offers a virtual environment where customers can explore various banking services, including deposits, loans, and government flagship schemes. Bank of Maharashtra has introduced Mahabank Metaverse, featuring a virtual humanoid that uses artificial intelligence, machine learning, and natural language processing to assist customers.

In India, several banks have also launched their virtual branches in the metaverse. Punjab National Bank (PNB) offers a virtual environment where customers can explore various banking services, including deposits, loans, and government flagship schemes. Bank of Maharashtra has introduced Mahabank Metaverse, featuring a virtual humanoid that uses artificial intelligence, machine learning, and natural language processing to assist customers.

The metaverse provides an opportunity for banks to engage with customers in new ways and reach decentralized platforms and communities. As technology continues to advance, it is expected that more banks will establish their presence in the metaverse by 2025, offering immersive experiences and leveraging the potential of virtual environments for enhanced customer interactions.

With metaverse creating opportunities for ‘metonomics’, days are not far when metaverse branches will become mainstream in coming days like mobile banking.

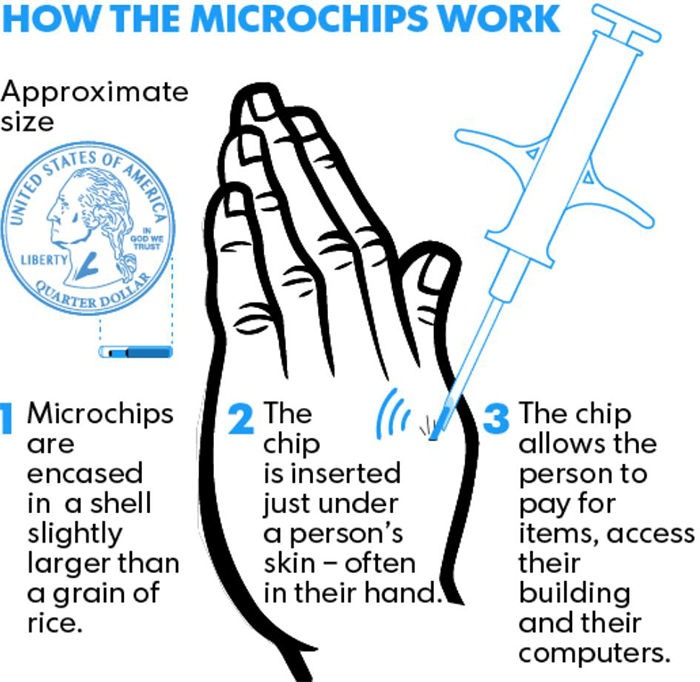

6. Payment through Implant Micro-Chip

A human microchip implant is an electronic device inserted subcutaneously, often through injection. Individuals ranging from hobbyists to scientists and business personalities have chosen to have RFID microchips implanted in their hands or by others.

These subdermal implants typically contain a unique ID number that can be connected to an external database. This database can store various information, including identity documents, criminal records, medical history, medications, address book, and other potential uses. Among the developed use-cases, one prominent application is facilitating contactless payments, similar to contactless cards.

However, it is important to note that this technology is still in the prototype stage. There are several risks associated with implanting these chips in humans, such as corrosion, infection, cancer risks, and privacy intrusion. Despite these challenges, it is expected that in the coming years, the concept of embedded finance will gain wider acceptance and evolve into a more comprehensive and risk-free solution.

7. Sustainable Finance

The importance of Corporate Social Responsibility (CSR) in business is rapidly rising. Sustainable finance refers to the systematic incorporation of environmental, social, and governance (ESG) considerations into investment decision-making within the financial industry. Consequently, there is a notable surge in the allocation of resources towards sustainable economic activities and initiatives with longer-term horizons.

Changes in investment preferences, especially for millennials who stand to gain over the next 20 years from the most significant transfer of inherited riches in recorded human history, totalling $68 trillion, have been a major factor in the birth of sustainable finance. To Incorporating social governance and environmental considerations as essential elements inside their investment portfolios, institutional investors are also revising their long-term investment risk models.

The sustainable finance market may be categorized into two distinct subcategories, namely negative sustainable finance and positive sustainable financing also called Green finance. Green finance takes money out of current companies that are fuelling the climate crisis (negative/exclusive) or invests in new companies who are coming up with innovative ways to combat climate change (positive/integrated). Negative, or exclusionary, green finance often transfers capital from high-carbon to low-carbon companies (a process referred to as divesting) or funds companies whose objective is to reduce their carbon footprint.

With ESG ratings being published and ESG reporting being mandated, days are not far when the allocation of financial resources towards un-sustainable finance will dry up and investors will only fund sustainable industry and businesses.

In Nutshell The FinTech industry has thrived amid global challenges like the Covid-19 pandemic, benefiting customers with flexibility, opportunity, and stability. To fully embrace FinTech, it needs to advance further, with a collaborative ecosystem ensuring an open, just, and integrated financial system. The speed of technological advancements assures us that this progress won’t take long. Additionally, investors are heavily investing in the FinTech industry, making it a favorable time for ventures..

Mr. Rakesh Goyal, Mr. Mitra Wani, Mr. Chintan Oza & Mr. Biren Parekh has equally contributed to this article.

About the Authors :

Mr. Rakesh Chandra Goyal

Advisory Board Member – Agile Network India

Director – Sunmitra Education Technologies Limited

Mr. Rakesh Chandra Goyal is Passionate about Corporate management to embrace Agility & inculcate Agile culture in their team and people across all functions as Agility would help in enhancing business performance through alertness & vigilance.

Mr. Rakesh Chandra Goyal can be contacted at :

LinkedIn | Website | Twitter | Facebook

Global Digital Transformation Leader | Business Technology Consultant | Enterprise AI & Automation Strategist

Mr. Mitra Wani can be contacted at :

Mr. Chintan Oza

Mr. Chintan Oza

Advisory Board Member – CLAIRIFIER

Chief Advisor – India Startup Ecosystem, Toronto Business Development Centre

Mr. Chintan Oza is a Ecosystem enabler for Startups & Investors in G20 &

BRICS, he has helped to build startups from scratch to IPO or acquisitions.

Mr. Chintan Oza is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/ch

Mr. Chintan Oza can be contacted at :

Mr. Biren Parekh

Director – CRISIL Limited

Mr. Biren Parekh is an Information Technology executive with over twenty-five years of experience managing and implementing complex BFSI digital transformation programs for top-tier global retail and corporate banks.

Currently, a Director at CRISIL Limited (as of June 2022), he is a certified corporate director with multiple global certifications like PMP, ACP, DASSM, PRINCE2, ITIL V3, PSM1, and CSM. He has also volunteered on the IEEE Innovation and entrepreneurship committee and the board of the PMI Mumbai chapter since April 2021.

Being one of the NEXT100 CIO 2020 winners, he is also a regular speaker at conferences and business schools like IIM, SJMSOM, NMIMS, PDPU, Delhi School of Economics and NITIE, where he conducts talks on project management, the Agile framework, Digital transformation and FinTech. He is also an angel investor in several Indian and international startups and even mentors for some of them.

He has been rated in “Top 25 thinkers on Project Management for April 2022” and “Top 50 thinkers in FinTech for Oct 2021 & Oct 2022” on the Thinkers360.com website.

Mr. Parekh has published a whitepaper titled ‘A Comparative Study of Vendor Selection Process in Global Outsourcing Industry with an Elucidated Scientific Approach’ in a reputed Scopus journal. He was also featured in the book ‘High Productivity Practices by Successful Leaders’ by Dr. Ravindran KA, whereby he shares tips on increasing productivity.

On the personal front, he is a fitness freak and a marathoner. He closely follows equity and enjoys reading, traveling, and exploring new cuisines. In his free time, he publishes articles on interesting topics on his website (birenparekh.com) and LinkedIn. His work has been featured in various magazines, blogs, and PMI journals.

He has published his book “Supercharge your Project Management skills” to share his experiences on his project management journey.

Mr. Biren Parekh Professional Experience :

https://www.linkedin.com/in/bi

Mr. Biren Parekh is Accorded with the following Honours & Awards :

https://www.linkedin.com/in/bi

Mr. Biren Parekh is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/bi

Mr. Biren Parekh is Volunteering in the following Industry Associations & Institutions :

https://www.linkedin.com/in/bi

Public talk by Mr. Biren Parekh

Mr. Biren Parekh can be Contacted at :

Email | Website | Blog | LinkedIn | Twitter | Facebook | Instagram

Also read Mr. Biren Parekh’s earlier article :