Understanding the Chinese economic fault line

The Business of Govt is not business but to facilitate business. But when govt indulges in Business it has its serious & devastating impact. Understanding Chinese economic model is important to derive strategy not to fall into trap again and stand up to fight.

The economic wisdom is rooted in a profound understanding of the relationships that exist between different orders of law that operate within an economic community. It is above the man-made laws and regulations that societies develop themselves; there are laws of nature that operate by virtue of the individual and social nature of human beings and human societies. It can be seen, in the same way that an artisan needs to take into account those laws of nature that operate to limit his artefacts, it is necessary for Organisations & Governments to take certain ‘natural laws’ into account when devising particular socio/economic arrangements.

Wisdom lies in going by the rules of the world and various laws of economics. Trying to rule the world with our own rules will have devastating effect as has been the case with Chinese Economy. Corona Virus may be the excuse to initiate action by global majors against China, it is the outburst of retribution what China have been doing for the decades.

China has taken undue advantage of Globalisation and WTA agreements. Both the global policies were designed to bring adherence & cohesive measures within developed and developing countries for inclusive growth. But Chinese action to derive benefit for being superpower has resulted into rise in income inequality, protectionism, creating differences between countries, disturbing global peace etc. Most of countries have started reemploying duties to safeguard their industries and the national income challenging globalisation.

However, for the lust of power Chinese move were against well established laws of economics that has to reciprocate some day. Effort to re-write laws by Xi Jinping has gone against him and the country. Through this short book effort has been made to expose those wrongs for better awareness by respective countries and economic entities and take precautionary measures in designing their cost structure based on economic principles for sustenance and inclusive growth.

China the fastest growing Economy

Prior to the initiation of economic reforms and trade liberalization nearly 40 years ago, China maintained policies that kept the economy very poor, stagnant, centrally controlled, vastly inefficient, and relatively isolated from the global economy. Since opening up to foreign trade and investment and implementing free-market reforms in 1979, China has been among the world’s fastest-growing economies, with real annual gross domestic product (GDP) growth averaging 9.5% through 2018, a pace described by the World Bank as “the fastest sustained expansion by a major economy in history.” Such growth has enabled China, on average, to double its GDP every eight years and helped raise an estimated 800 million people out of poverty.

China became the world’s largest economy (on a purchasing power parity basis), manufacturer, merchandise trader, and holder of foreign exchange reserves. This in turn has made China a major commercial partner of the United States. China is the largest U.S. merchandise trading partner, biggest source of imports, and third-largest U.S. export market. China is also the largest foreign holder of U.S. Treasury securities, which help fund the federal debt and keep U.S. interest rates low.

The Chinese government had made innovation a top priority in its economic planning through a number of high-profile initiatives, such as “Made in China 2025,” a plan announced in 2015 to upgrade and modernize China’s manufacturing in 10 key sectors through extensive government assistance in order to make China a major global player in these sectors. However, such measures have increasingly raised concerns that China intends to use industrial policies to decrease the country’s reliance on foreign technology (including by locking out foreign firms in China) and eventually dominate global markets.

China’s growing global economic influence and the economic and trade policies it maintains have significant implications for the United States and hence are of major interest to Congress. While China is a large and growing market for U.S. firms, its incomplete transition to a free-market economy has resulted in economic policies deemed harmful to U.S. economic interests, such as industrial policies and theft of U.S. intellectual property. This report provides background on China’s economic rise; describes its current economic structure; identifies the challenges China faces to maintain economic growth; and discusses the challenges, opportunities, and implications of China’s economic rise for the United States.

Increasing its capacity at reduced cost, China not only disturbed US Economy but also all of global economies. Many industries across globe were closed.

China’s Economic slowdown

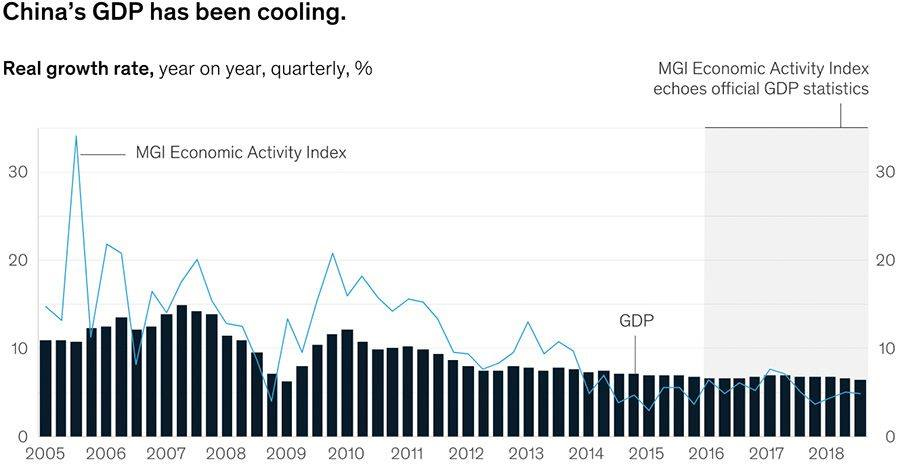

As China’s economy has matured, its real GDP growth has slowed significantly, from 14.2% in 2007 to 6.6% in 2018, and that growth is projected by the International Monetary Fund (IMF) to fall to 5.5% by 2024. The Chinese government has embraced slower economic growth, referring to it as the “new normal” and acknowledging the need for China to embrace a new growth model that relies less on fixed investment and exporting, and more on private consumption, services, and innovation to drive economic growth. Such reforms are needed in order for China to avoid hitting the “middle-income trap,” when countries achieve a certain economic level but begin to experience sharply diminishing economic growth rates because they are unable to adopt new sources of economic growth, such as innovation.

However, the bubble was shortlived. Economic activity weakened in 2018: Official statistics placed real GDP growth at 6.6 percent in 2018, the lowest rate since 1990.

Why Economic Growth has been short lived

In the lust of being economic superpower Chinese government has made innovation a top priority in its economic planning through a number of high-profile initiatives, such as “Made in China 2025,” a plan announced in 2015 to upgrade and modernize China’s manufacturing in 10 key sectors through extensive government assistance in order to make China a major global player in these sectors. However, such measures have increasingly raised concerns that China intends to use industrial policies to decrease the country’s reliance on foreign technology (including by locking out foreign firms in China) and eventually dominate global markets.

The last ten years of stimulus and deleveraging is a story of “eight-plus-two.” Eight years of government stimulus after the global financial crisis, followed by a couple years of conscious deleveraging and credit reduction. China’s debt-to-GDP ratio soared from 120 percent in 2007 to 253 percent in Q2 2018 (higher than the ratios in Germany and the United States).

Fast industrialization process and output maximization has increased domestic competition that compelled industries to reduce its price while compromising quality. In order to prevail upon international market and maintain its competitiveness, China had been manipulating its economy devaluing its own currency. This process has lead to lower industry realization and increased borrowing leading to corporate debt of $13 trillion+ as of date.

On the other hand in order to ensure competitiveness, salaries across china has been extremely poor that resulted in lower purchasing power of domestic consumers despite having huge population and domestic market.

Global impact

Cheap products and cheap exports have caused exponential damage to global economy. China dreamt of creating whole world as its trading partner. Many entities across globe have failed to compete with the Chinese price and had to close down their units. This has angered the whole world, particularly US that lead to US-China trade war joined by many countries off late. The mistakes committed by China are irreparable.

The prices of various products on offer were beyond logical costs. Variable costs of major raw material are the same for all the countries and economic entities subject to logistics cost. How could China derive special price to offer at low price?

China has disturbed global economy. It has taken undue advantage of Globalization & WTA framework and misutilized FTAs that has resulted into protectionism measures, income inequality and political indifference between nations. It has caused huge unemployment to rise across globe. But all these have come with rider to China itself. China has committed too many mistakes in the process that will have devastating impact over its own economy. Global economies may recover from the impact in the long term but it will be extremely difficult for China to recover. Given global trust and faith it has lost is difficult to win over again.

Mistakes committed by China

- Instead of optimizing its output based on overall global demand, increased supply side by China has lead to intense domestic competition.

- Intense competition has lead Chinese industries to reduction in prices of most the products in most of the categories.

- The price war resulted in compromising with quality.

- China did not allow salaries to grow that adversely impacted its inclusive growth

- Instead of optimizing its cost, lust to capture global market through cheap products has gone against its own economy.

- Currency devaluation has adversely impacted its own industries and put them under huge debt.

- Huge investment across countries in the lust of geo expansion and colonisation move has put pressure in its central bank.

- With huge debt, Chinese banking system has started collapsing.

- Due to lower income of its own population, internal demand will be extremely poor leading to fast deterioration of the economy herein after.

As on date, thousands of Chinese industries have been closing down rendering millions jobless.

Way forward with Industry 4.0

The idea behind exploring details of Chinese economic model is for the reason that understanding economic stress point leverages Business Leaders to get best investment results.

Because China was highly aggressive, none of the economies globally in respecting WTO & FTA rules have taken any action to beat China. Bound by limitations, China has beaten itself. Economic entities hereinafter have to prepare themselves to beat China and countries like China.

It will be difficult for China to revive its own economy again at least in next decade. Several measures taken by several govt across nation including India to contain China & block import from China combined with US-China trade war has created a huge business pace both in domestic market and international market. Supply Chain interruption due to pandemic has also created huge vacuum.

With opportunities ahead, industries across globe and its respective Govt’s are expected to learn huge lesson and take necessary corrective action. Learning’s are fast becoming the most influential driver of action and shaper of decisions today. Corporate boardrooms have to find space in their conversations for today’s geopolitics. Once the playfield of business leaders and investors, the overriding conversations in all boardrooms today are linked to this new intimacy between profits, growth, and investor returns de-risking the company from actions of China and on China. Rapidly changing geopolitics is witness to protective digital walls, decoupling of supply chains from perverse dependency and efforts to secure citizens and nations from the dragon’s consumptive gaze. This is the permanent, central and real agenda for corporations and top executives across the world.

2020 is being considered as a curse year for entire globe. What if I say 2020 is the new beginning to see a new coming for global economic actors? The decade ahead will be increasingly shaped by geopolitics. it will be driven by political and economic interests and indeed governments will set no-China boundaries for corporations. As citizens reject products from China, boardrooms will have to account for more than just their bottom-line.

Chinese mistakes has provided ample opportunity for serious seekers who want to capitalise the opportunity to occupy international space created by China by being competitive & cost-efficient ethically & morally reading operational economic fine prints & global ever changing economic parameters and demand scenario. Provided further, Indian corporations must ensure inclusive growth to maintain purchasing power of the domestic population aligning changing consumer behaviour.

Sustainability is rapidly becoming a strategic priority for businesses. Business Leaders worldwide expect their organization to capture competitive advantage…. Globalization & Digitization has pushed the organization in a direction that represents new normal of uncertainty… Survival or growth of enterprise depends on capacity to generate wealth across value chain. Organisations have to be cost-efficient and competitive on their own in VUCA World to ensure sustainability enduring growth.

Each vacuum is followed by an intense storm. The market space, is being filled by nations like Bangladesh, Vietnam, Phillipines, Indonesia etc, whereas, Indian industries is still striving hard due to higher cost & price. Instead of taking corrective action, Indian industries are looking at Govt for sops, incentives, exemptions etc. However, much of positive steps have been taken by Indian Govt in reduction of taxes etc. But with no difference yet.

Economies are recognized by its Economic Entities and how they perform.

To occupy the business space created by China, economic entities have to be cost-efficient and competitive at least to occupy domestic business space. Industry 4.0 is not just about technological advancement; it is more about improving productivity and operational efficiency through Business Analysis, Business Intelligence and Decision Intelligence. There has been paradigm shift in the way we do business and perform in the economy.

Manufacturing is a dark place, shrouded in clouds. It is no more limited to assembly of parts or preparing input basket for a product. Business is governed by Economic Principles both at macro level & micro level. Ignoring these principles to neutralize ever evolving macroeconomic changes will have serious and disastrous impact over the businesses. Ignoring such economic stress points will set organizations to fail.

Industry 4.0 and Tools of AI facilitates economic analysis to derive business strategy. Developing Performance Pillar relevant to the technology will lead to organizational success enduring growth.

In the name of cost reduction organizations only know reducing manpower. This is even suggested by Top & renowned consultants in the name of improving performance of organisations. Across my four decade of career I have encountered many such renowned consultants who on the pretext of improving performance with high return, on one hand they charged hefty amount, on the other hand they end up in suggesting their tailor made suggestion- Reduce Manpower. In order to reduce expenses, I have also witnessed suggestions to withdraw facilities and employees well being amenities that have never added any value to any organization. Instead it has proved otherwise.

Little did they know cost is like air in the balloon? Compressed at one side, it will bulge at the other….Wonder why operational efficiencies are ignored?

Selective actions and improvements have its own limitations. Any selective action will have its impact on other cost parameters. Like China increased its production capacity to create competition within its own country that has adversely impacted the quality of Chinese product. Costs are not subject to reduction. It is subject to optimization. Increasing unemployment through redundancy / voluntary attrition or reducing Gross Overall Happiness of employees including paying less salary has not favoured any businesses. Other than adversely impacting organizations through compromised quality leading to increased operational and production cost, loss of purchasing power will impact economic growth of economic entities and economies. Such an action is detrimental to national economic cycle similar to Chinese economic wisdom.

Growth scaling sales revenue has not improved bottom line. Organisations have to improve its Total Factor Productivity and should focus on Multi-factor productivity through optimal allocation and utilisation of resources in use. Performance analysis of many leading industries has shown shocking results. None of the factors are in term and uniformity with each other. Purportedly CEOs are interested only in sales & production numbers.

Industry 4.0 facilitates this besides neutralizing all the governing factors. It helps in improving productivity and optimizes costs across resources. By being cost-efficient, it helps industries to beat manipulative practices.

Business is no more limited to conventional norms of selective improvement. It has to undergo holistic transformation. A transformation is not a series of incremental changes, it is a fundamental reboot. It has to represent a fundamental and risk laden reboot of a company with a goal of achieving dramatic improvement in performance and altering its future trajectory.

Developed nations have always tried to do business at the cost of developing nations. Much of hype has been created in the name of Industry 4.0 to keep developing nations at bay. The market & organizations stands confused today to delay implementation as revealed by my discussion with several CXOs & Business Leaders.

But in globalised & integrated world, underperformance of any one country will deeply impact rest of the world. Imposing sanctions in any one country adversely impacts other countries. However, for the sake of superiority some countries practice this purposely to keep globalised world under check.

No one country can ever grow in isolation. Similarly, no one organization can ever grow in isolation, at least not at the cost of its own organization.

Today Customers are willing to pay higher price provided the brand has social value. Creating value within the product / services, across operational segment organization, and across society can only help organizations to grow.

Ask yourself, as a Customer Why I should buy your product?

In having competitive advantage, organizations have mammoth task ahead that is not capable of being ignored. Adopting holistic change, they need to occupy the business space and move forward. They must think why pioneer of Retail and Retail Chain King has to sell his organization? There are many such examples why global majors have failed. If not adopted change, we can see more such failures, sell outs, M&As, takeovers etc in days to come.

My earlier articles here – Sustaining in Challenging World and under New Normal, and, Industry 4.0; Adding Capabilities Industry Leaders need to Re-incarnate has thrown some light to evolve and succeed.

My next article will decode the mystery of Industry 4.0 and will discuss about the Performance Pillar that need to be developed by every organization for being cost-efficient & competitive to remain relevant and to achieve sustainability goal.

Business value is not a value. Business Value is a Model. Business Value Model what we value.

About the Author

Equipped with Business Economic Wisdom through Four decade leadership across diverse industries, Manoj Trivedi is now empowering organizations, Business Leaders and CXOs with secrets of success building capabilities relevant to Industry 4.0. Such performance pillar being fundamental to business is even applicable under conventional manufacturing system and will help in smooth transition to new normal. He can be reached at (91) 9051831961 / 9433013863 or [email protected] for consultation and mentorship.

Also read my earlier articles