Evolving Cyber Threats and Growing Security Opportunities in BFSI sector

Over the years, the banking sector has experienced significant changes in adapting to growing technologies and financial services continue to evolve in enabling robust cybersecurity practices for safeguarding sensitive information, managing risks and in maintaining customer trust. With enduring technological advancements, the level of online transactions is rising day by day, offering enhanced accessibility for both customers and financial institutions. Based on the recent studies and surveys, the increase of cyber incidents and ransomware attacks reported across various industries has affected across sectors, however, financial institutions have emerged as the sector most affected.

Global Banking Security Market is estimated reach a staggering amount of US$8.52TN and is projected to result in a significant increase, leading to a market volume of US$10.83TN by the year 2029 (Source: Statista Market Insights). Despite global economic challenges, the banking sector in countries worldwide continues to innovate and adapt to digital transformation to meet the evolving needs of customers. This study has considered the base year as 2024, which estimates the market size of market, and the forecast period is 2024 to 2029. New regulations and Standards, such as Sarbanes-Oxley Act (SOX), SOC, ISO, Basel II, Data Privacy, Consumer Privacy, Anti-Money Laundering (AML), CCPA, PDPA, GDPR, NIST, HIPAA, PCI DSS etc. need to be carefully analyzed and controls need to be defined while adapting to emerging technologies in this digital transformation period. Financial institutions should stay focused on complying with, design and implement a security framework and necessary processes in a manner to demonstrate compliance with these regulations/laws. It is important for a cybersecurity team to identify the information flowing in and out of the organization including third parties, service providers and sub-contractors ensuring the process is defined, assessed, monitored and managed to reduce risks.

What is changing in the Banking Industry –

- Digitization

- Cloud Migrations. Moving data to Cloud in Private/Public/Hybrid

- Mobile Banking

- Unified Payment Interface (UPI)

- Blockchain Integration

- Generative Artificial Intelligence (AI)

- Adopting to Zero Trust Maturity Model

- Preparing to comply with new BFSI act, DORA (Digital Operational Resilience Act)

- Increasing Cyber Resilience Operating Model

- Privacy Implementation across Geos for securing personal data

The most common trend in the financial industry today is the shift to digital transformation, specifically mobile and online banking to increase the availability, scalability and convenience for the customers and financial institutions. As the availability increases in today’s era of unprecedented cyber threats, banks must take exclusive steps in enabling robust cybersecurity controls to use the emerging technologies with ease. Cyber security concerns influencing online banking transactions are one of the biggest concerns. Cybercrimes are increasing because of the technology’s rapid growth and widespread applications without taking required security measures. Banks must invest in next-generation security solutions to enhance the existing security posture, continuous education in increasing the competencies of the security resources while adapting to new security trends and vigilance in their digital interactions.

Cyber Risk base requirements and recommended safety measures –

- Develop robust Security posture aligning to Enterprise Threat landscape

- Enterprise Risk Management

- Build Business Resilience acclimate to industry best stds.

- Real-time detection using continuous monitoring

- Giving visibility to the effects and the extent of damages by saving logs and analyzing data

- Continue strengthening security methods to allow correct decisions to be made By putting these measures into practice, corporations can minimize the risks.

- Manage administrative privileges with appropriate authorization and authentication

- Cybersecurity Incident response plan in place.

- Training & Awareness.

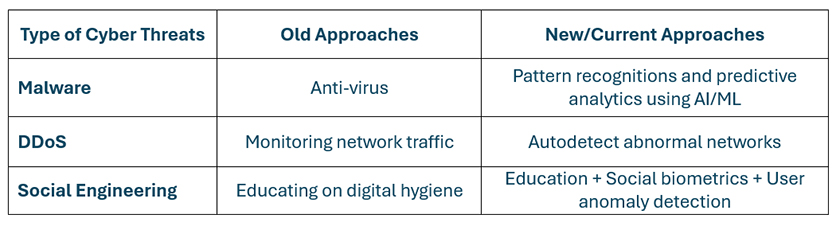

Some of the key changes happening around us now are –

What to expect in 2025 and beyond –

Day by Day the practices and approaches used by banking institutes are not limiting to one or two, its significantly changing the ways to address the challenges and manage them more effectively in today’s threat environment by adapting to various new gen security controls to increase the business and cyber resilience. In today’s digital society in which ICT and Internet connectivity are indispensable, ensuring security controls are in place is one of the most essential requirements in various places to manage the organization culture effectively without getting preyed to predators. Also, it’s very important to change the old legacy models and integrate the current practices with the new gen. security models to stay business resilient. Some of the key elements to relook into are –

- Protection of an ever-increasing attack surface will gain importance.

- Cloud Security Assessments and Implementation.

- Gen AI (Artificial Intelligence) based automation for gap analysis and reducing incident response times.

- Automizing Manual Efforts in doing Risk Assessments, Stress Tests, Visualization and Reporting.

- 100% compliance with Data Privacy and Regulations.

- Global supply-chain issues will become data-protection issues.

- Need for DPO (Data Protection Officer) will be in high need.

The BFSI security market offers various opportunities driven by technological innovations, growing threat landscapes, and the increasing need for robust security measures during the digital transformation. Opportunities exist for the development and adoption of various advanced next gen solutions like threat detection solutions using technologies such as artificial intelligence (AI), machine learning (ML), Public/Private/Hybrid clouds using advanced data security solutions, increasing blockchain technologies, robust incident response planning and behavioral analytics to identify and mitigate sophisticated cyber threats. There are many security solutions to secure the infrastructure of a financial institution like GRC, designing and implementing zero trust, enabling robust network security controls, vulnerability management, SOC operations, endpoint security, disaster recovery, business continiuity and many more. The importance of cybersecurity for the BFSI sector cannot be overstated, given the critical role financial institutions play in managing enormous volumes of sensitive data and being involved in various online transactions. By enabling robust security controls and implementing comprehensive cybersecurity measures in the right places will help the banks and financial institutions to effectively mitigate cyber risks and safeguard their operations. Being vigilant and taking proactive approaches to cybersecurity, the BFSI industry can increase customer trust, protect customer assets, and maintain its reputation in this fast-growing digital world.

About the Author :

Ms. Kavitha Srinivasulu

Global Head – Cyber Risk & Data Privacy – R&C BFSI

CCISO | DPO | CISM | CEH | CCSO | CCIO| PCSM | PDPP |

Ms. Kavitha Srinivasulu is an experienced Cybersecurity and Data Privacy Leader with overall 21 years of experience focused on Risk Advisory, Data Protection and Business Resilience.

Ms. Kavitha Srinivasulu has demonstrated expertise in identifying and mitigating risks across ISO, NIST, SOC, CRS, GRC, RegTech and in emerging technologies with diverse experience across corporate and Strategic Partners.

Ms. Kavitha Srinivasulu possess a solid balance of domain knowledge & smart business acumen ensuring business requirements and organizational goals are met.

Ms. Kavitha Srinivasulu is a Board Member of Women in CyberSecurity (WiCyS) India

Ms. Kavitha Srinivasulu is an Executive Committee Member CyberEdBoard Community

Ms. Kavitha Srinivasulu is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/ka

https://www.linkedin.com/in/ka

Ms. Kavitha Srinivasulu can be contacted at :

LinkedIn : https://www.linkedin.com/in/ka

Also read Ms. Kavitha’s earlier article: