Digital Darwinism in Banking : How Gen AI-Driven Products Will Determine the Survivors

In today’s world where banking is not done only by traditional large banks but also by a set of new, digital only, challenger or non-banking players. While existing customers of traditional banks are not completely cutting off their relationship but increasingly shifting their financial activities to new players. This quiet attrition signals arrival of ‘Digital Darwinism’ in banking. In that context, adaptation of Generative AI with proper use cases will not only provide another competitive advantage but build the ground for survival.

The Great Banking Divide

Today’s banking landscape can be split into two broad species

Traditional Titans: Banks with burden of legacy despite some level of modernization, owning huge data, excess inertia, siloed operations and product-first mindset

Digital Disruptors: Fintech that are customer-centric, technology driven, agile mindset in execution. They challenge traditional banks in multiple ways to do banking differently.

As Darwin observed that it is not the strongest but those that are most adaptable survive. Similarly, in the banking ecosystem, while Gen-AI is coming with lot of potential either operational efficiency gain or outstanding customer service or completely different business for personalized banking, evolutionary pressure will be more. This will decide the fate of banking institutions, both new and old.

The Silent Customer Exodus

Studies show that account closure rates in traditional banks is almost stable however their transaction volume have declined over time while users started taking same services from fintech more.

Similar patterns emerge across the industry: customers maintain their primary accounts but increasingly use them as mere way stations for funds headed to specialized services.

“Banking customers today don’t necessarily break up with you – they just see other people on the side,” quips Brett King, founder of Moven and banking futurist. “And eventually, those relationships become the primary ones.”

This phenomenon is particularly pronounced among younger demographics. According to a 2024 Cornerstone Advisors study, 41% of Gen Z consumers and 38% of Millennials now consider a fintech app – not a traditional bank – their primary financial relationship.

Why Traditional Banks Struggle with Innovation

What explains this paradox where traditional banks, despite their resources, often lag in customer-centric innovation? The answer lies in fundamental structural and philosophical differences:

1. Product-First vs. Customer-First: Traditional banks organize around product lines, each with its own P&L, creating internal competition and fragmented customer experiences. Chase Manhattan Bank famously discovered that high-value customers were being contacted by seven different divisions with competing offers – sometimes in the same week.

2. Organizational Silos: In many established banks, compliance, risk, IT, and customer experience teams operate with separate and often conflicting KPIs. Compliance team of a large bank might require five forms of identification for regulatory reasons while their customer experience team aims for one-click onboarding – with no mechanism to resolve this contradiction.

3. Legacy Technical Debt: A few large banks e.g. JPMC, BoA still maintains critical systems written in COBOL – a programming language from 1959. Such technical foundations make rapid innovation nearly impossible.

4. Risk-Averse Culture: When large banks survey employees about barriers to innovation, “fear of compliance violations” ranks one of the tops– ahead of “technical limitations” or “budget constraints.”

The Fintech Advantage

By contrast, digital-native financial institutions approach the market fundamentally differently:

1. Customer Journey Centricity: Revolut helps people manage money easily. The app offers banking, budgeting, investing, and insurance in one place. Users get real-time alerts when they spend money. The app also has tools to help people save money (over 35 million users as of 2024). Everything is easy to use and well connected. Because of this, Revolut has grown quickly. Today, millions of people around the world use it.

2. Unified Experience Design: Nubank is a fintech company from Brazil. It offers credit cards, loans, and bank accounts in one app. The app is clean and easy to use. Customers can check balances, pay bills, and get help in the same place. This makes banking simple and stress-free. This company has redefined user experience design to a different level.

3. Agile Technical Foundations: Stripe uses ‘Agile Foundations’ to stay flexible and scale fast. They prioritize automated testing, continuous integration, and modular architecture. This helps their teams deploy new features quickly and safely. For instance, when launching Stripe Radar (a fraud detection tool), they used small, frequent updates to adapt quickly to user feedback and fraud trends.

Fundamental flow of a neobank

4. Experimentation Culture: PayPal encourages teams to test new ideas quickly. For example, they experimented with different checkout flows to reduce cart abandonment. Small user groups got different versions, and PayPal used the results to pick the best one.

Generative AI: Banking’s Evolutionary Catalyst :

Generative AI represents a potential reset moment. The enablers that could either amplify these differences or provide traditional banks with an opportunity to leapfrog ahead.

The following transformative applications already exist:

1. Hyper-personalized financial advice: Singapore’s DBS Bank deployed an AI system that analyzes transaction patterns. It works with real life events to provide tailored financial guidance. Early results show a moderate increase in advisory service adoption. It helps to achieve higher customer satisfaction.

2. Conversational banking interfaces: Capital One’s Eno and Bank of America’s Erica have evolved from simple chatbots to sophisticated virtual assistants. They can anticipate needs based on past behavior. They have the capabilities to structure unstructured customer requests into actionable steps.

3. Predictive financial wellness tools: Huntington Bank’s “Heads Up” feature uses generative AI to analyze spending patterns. This proactively alerts customers to potential financial issues. It happens before the actual occurrence. It significantly reduces overdraft incidents

4. Automated regulatory compliance: HSBC implemented AI systems generating compliance documentation. It reduces compliance processing time while improving accuracy.

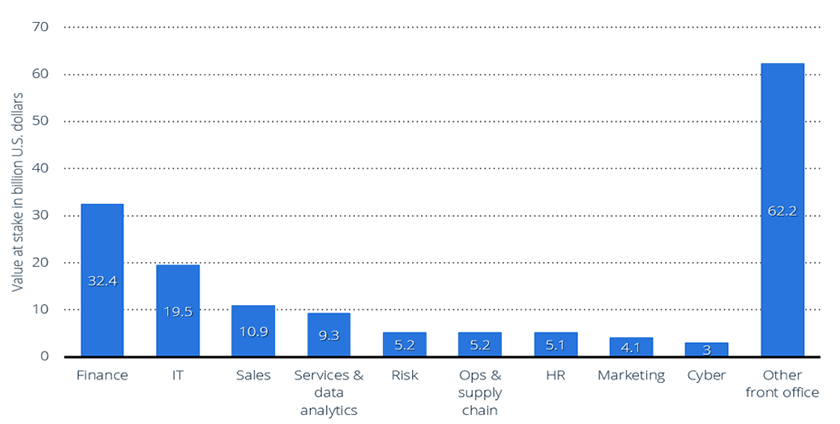

Potential Gen-AI value in banking worldwide 2025 by segment (Source: Statistia’25)

The Data Advantage Paradox

Traditional banks undoubtedly have huge advantage of rich historical and transactional data, which can be used for training for modelling for potential use cases. However, many incumbents also struggle to leverage this advantage due to data fragmentation across multiple systems including legacy systems, restrictive data governance, cultural resistance to change. Also, many gen-Z and millennials with strong AI background prefer to work in challenger banks, as opposed to traditional behemoths, to add their values where they are more welcome to implement their fresh ideas. At the same time, digital challengers are also building AI capabilities to entice customers.

- Acquiring customers at lower costs through superior digital experiences

- Forming strategic partnerships to enrich limited internal data

- Creating engagement loops that rapidly generate new behavioral data

- Implementing “data-first” architectural decisions from inception

Darwin’s Banking Prediction

As banking industry is undergoing evolution, here are the trends emerging:

1. The hybrid winners: Neither traditional bank not digital challengers have the ultimate mote to succeed in Gen-AI age. Those that can harness their rich data, shift to customer-centric mindset and deliver personalized products based on data analytics, operate very nimbly will acquire and grow customers with high stickiness.

2. Acquisition acceleration: Unable to transform internally fast enough, more traditional banks will acquire AI-native fintech not just for their technology but for their innovation culture. PNC’s acquisition of Lulo Bank and integration of its AI leadership into core operations shows this strategy in action.

3. AI-native banking: We’ll see the emergence of the first truly “AI-native” banks, where artificial intelligence isn’t just a feature but the foundational architecture. Early examples like Personetics’ Engagement Banking platform hint at this future.

4. Specialized symbiosis: Some traditional banks will strategically retreat from direct customer relationships, instead providing “banking-as-a-service” infrastructure to AI-powered customer-facing fintech, creating new symbiotic relationships in the financial ecosystem.

The Survival Imperative

For traditional banks, the Darwinian imperative is clear: evolve or face extinction. But evolution doesn’t mean abandoning strengths – it means adapting them to changing environments.The banks that survive will be those that leverage their unique advantages – customer trust, regulatory expertise, and rich historical data – while radically transforming how they organize, innovate, and engage customers through AI. As Charles Darwin observed, “It is not the strongest of the species that survives, nor the most intelligent; it is the one most adaptable to change.”

In banking’s new AI-driven landscape, adaptability will determine which institutions thrive and which become cautionary exhibits in the financial natural history museum. The clock is ticking. The quiet customer exodus continues. And in banking’s evolutionary race, Generative AI has just changed the pace from gradual evolution to revolutionary adaptation.The survivors will be those who recognize that in Digital Darwinism, there is no middle ground between evolution and extinction.

About the Author :

Mr. Suman Chandra is a Senior Technology Executive and Agile Transformation Advocate who consistently creates business value by delivering products that harness the power of Data, Analytics, and AI.

Mr. Suman Chandra is a trusted advisor and strategic partner to C-suite and leadership teams delivering high-impact digital programs and solutions in multiple industries including Financial Services.

Mr. Suman Chandra is keen on the strategic use of Generative AI in organizations.

Mr. Suman Chandra is based out of New York City – Metropolitan Area, USA.

Mr. Suman Chandra is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/su

Mr. Suman Chandra is Volunteering in the following International Industry Associations & Institutions :

https://www.linkedin.com/in/su

Mr. Suman Chandra can be contacted at :

Mr. Raja Basu is a Senior Consulting professional in a leading MNC.

Mr. Raja Basu is a Senior Consulting professional in a leading MNC.

Mr. Raja Basu works as a business architect and helps global banking and financial markets clients to enable their digital transformation journey.

Mr. Raja Basu has special interest in responsible use of AI and sustainability.

Mr. Raja Basu is also pursuing his doctoral studies (PhD) from XLRI Jamshedpur.

Mr. Raja Basu is based out of Kolkata, India.

Mr. Raja Basu is an experienced leader in both technology and business, he has a proven track record of defining and implementing technology-driven transformations for clients in the global banking and financial markets.

Mr. Raja Basu focus lies in automation, particularly artificial intelligence (AI), and its impact on climate and sustainability (SCR).

Mr. Raja Basu possess a deep understanding of value-driven advisory practices, which have played a significant role in building strong client relationships. Throughout his career, he has actively contributed to numerous transformation programs involving complex applications for international clients across the United States, Canada, Europe, and Singapore.

Mr. Raja Basu is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/ba

Mr. Raja Basu is Volunteering in the following International Associations & Institutions :

https://www.linkedin.com/in/ba

Mr. Raja Basu is Accorded with the following Honors & Awards :

https://www.linkedin.com/in/ba

Mr. Raja Basu can be contacted at :

Also read Mr. Raja Basu’s earlier article :