Business imperatives of ChatGPT & Generative AI – A BFS industry perspective

In this article we have tried to explore empirically how ChatGPT can enrich financial services industry. Artificial intelligence has become a household technology due to its high rate of adoption and tangible benefits.

Language model based Artificial Intelligence tools have seen spectacular rise in the last few years – Google’s transformer algorithm in 2017 to OpenAI’s GPT3 in 2020 & Dall-E in Sep 2022 to ChatGPT in Nov 2022. And in few days, it has kind of taken over the world, taking corporates to Govts on a frenzy ride. While kicking off an arms race among mega corporates, businesses exploring possible use cases, researchers talking about the explosion of parameters in large language models, ethics experts on the possible exploitation by propaganda machinesto regulators on creating guidance and framework of use…. the list goes on.

Artificial Intelligence and machine learning models trained to mimic human behavior, identify patterns from large amounts of data, respond from predefined information pool etc. has come a long way over years and reached an inflection point. From being predictive it has become generative, producing, and adjusting outcomes from prompts, generating codes, writing essays, to painting images with impeccable quality seemingly performed by human being. Creativity, the distinctive characteristics of human beings, is partially being acquired by machines… Artificial Intelligence closing in on human intelligence.

This transformative technology has the potential to augment functions across multiple industries. As defined by ChatGPT init’s own words, it can augment almost all critical and substantial business functions from customer service to product development to supply chain management to communication across industries – from financial services to auto to manufacturing to defense. Even an AI bot flew an F-16 fighter jet recently in Southern California skies, while agricultural usage combining AI with drone technology has gained pace.

Let’s try to have a closer look at BFS sector, where the capabilities can be leveraged with significant upward impact:

From the banking and financial services industry perspective, below are some the top business functions where we think ChatGPT and Generative AI, the technology behind ChatGPT can be leveraged with significant positive impact:

Customer service and personalization:

Data and AI can help better understand customer choices and preferences, automate customer inquiries and complaints, provide personalized recommendations, and offer 24/7 support. Combined with natural language processing capabilities, it can respond to global customer base at ease, agnostic of language barriers.

Generative AI can assist in creating conversational chatbots that can help customers with their banking needs, providing a more personalized and engaging experience. Combined with natural language processing, it can bring back some of the missing human touch from pandemic era.

Fraud detection and prevention:

It can analyze patterns in transactional data, customer purchase habits, with related information and identify fraudulent behavior, reducing financial losses.Simultaneously, producing wide range of scenarios and supporting data sets helping improve the validation process and coverage.

Portfolio management:

Generative AI can help banks and financial institutions to optimize their investment portfolios, identifying opportunities for growth and mitigating risks. M/L models can be trained with domain specific knowledge like market behaviour, fundamental and technical analysis models to enable churn portfolios in sync with risk appetite.

Credit scoring:

One of the critical business functions, where AI based tools can analyze credit scores and risk profiles, improving accuracy and reducing the risk of default. Additional supporting parameters, like payment history, funds flow analysis, psychometric analytic models etc. can be incorporated and evaluated in sync providing a more detailed view of the customer aiding better decision making in credit approval process.

Wealth management and investment advisory:

This is one of the niche business segments for banks with high focus. AI based tools can assist relationship managers by analyzing customer data and recommending personalized savings &investment strategies with optimal capital allocation.

Predictive analytics:

Analytics has been on the rise, with large amounts of data flowing from all directions. AI aided with higher computational power can analyze large amounts of data and forecast future trends, such as market fluctuations or customer behaviorfor informed investment and business decisions.Though, it calls for the M/L models to be trained with specific clean data sets and algorithm, we think it will be worth the investment.

Compliance and regulatory reporting:

Adapting to the fast-changing regulatory environment is always a challenge for financial services industry. Generative AI aided tools can assist in automating regulatory reporting and compliance by analyzing large amounts of data and identifying potential issues.

Explore the potential but tread with caution.

While the technological potential of AI and particularly Generative AI are immense, it is also subject to pitfalls and can be exploited by bad actors.

Capability increases so also bias:

Like any new technology, this has to be explored with caution. Large models trained over internet of data acquire social, cultural and all the myriad biases of internet as well.

As per a 2022 report by Stanford University: “A 280 billion parameter model developed in 2021 shows a 29% increase in elicited toxicity over a 117 million parameter model considered the state of the art as of 2018.”

Biases grow in proportion to increased capability.

More the data more the carbon footprint:

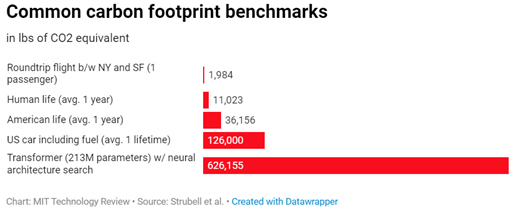

With the climate reporting regulations expected soon and with social commitments forming an integral part of corporate citizenship, these large data intensive models create a concern. As per the MIT Review report below, Google’s transformer model produced around 284 metric tons of CO2 with 213 million parameters.

In comparison, GPT-3, the predecessor of ChatGPT was trained on 175 billion parameters. Also, as we feed more data to train the models, the carbon footprint increases.

Balancing the climate commitments with the choice of technology basket will be a tricky water to tread for the financial services institutions.

A propaganda machine in the hands of bad actors:

In the pervasive era of google search, the acceptance of system outputs has increased over in-person advice. With humanly response generated by generative AI based tools, it will be nearly impossible to segregate misinformation. Manipulated information has the potential to play havoc in financial and economic decision making.

All the eyes are on this new transformative technology. Its too early to assess its full potential, address ethical concerns while bringing in a framework for responsible use. Though BFS sector is always on the forefront of using new technologies, its advised to approach with caution with MVPs. Interesting days ahead to explore promising use cases. Stay tuned. Top of Form

About the authors :

Mr. Aroop Ray, is a consulting partner in a global technology MNC. A passionate problem solver, Aroop works closely with C-suite leaders shaping their future technology roadmap by leveraging new age digital technology.

Mr. Aroop Ray, is a consulting partner in a global technology MNC. A passionate problem solver, Aroop works closely with C-suite leaders shaping their future technology roadmap by leveraging new age digital technology.

Mr. Aroop Ray can be reached at :

Dr. Manas Panda Ph.D is a partner in a leading technology MNC helping banks and financial institutions implement their digital transformation strategies. A Stanford LEAD alumni, he focuses on technology innovations in financial services. Based in Toronto, Canada.

Dr. Manas Panda Ph.D is a partner in a leading technology MNC helping banks and financial institutions implement their digital transformation strategies. A Stanford LEAD alumni, he focuses on technology innovations in financial services. Based in Toronto, Canada.

Dr. Manas Panda can be contacted at:

Mr. Raja Basu is a Senior Consulting professional in a leading technology MNC. In his current role he works as a business architect and helps clients to enable their digital transformation journey. He has special interest in responsible use of AI. He is also pursuing his doctoral studies (Ph.D) from XLRI Jamshedpur. He is based in Kolkata, India.

Mr. Raja Basu is a Senior Consulting professional in a leading technology MNC. In his current role he works as a business architect and helps clients to enable their digital transformation journey. He has special interest in responsible use of AI. He is also pursuing his doctoral studies (Ph.D) from XLRI Jamshedpur. He is based in Kolkata, India.

Mr. Raja Basu can be contacted at :

Also read Mr. Raja Basu’s earlier article :