Discriminative AI vs. Traditional AI : Evolution, Industry Adoption, and Future Trajectories

Introduction

Artificial Intelligence (AI) has evolved from rigid rule-based systems to powerful, data-driven learning models that now permeate every major industry. As enterprises adopt AI to drive efficiency, enhance decision-making, and offer personalisation at scale, two foundational paradigms shape this transformation:

Traditional AI – Symbolic or rule-based systems built on logic and expert knowledge.

Discriminative AI – Data-centric models that learn to make distinctions or predictions from labelled data.

Understanding the differences between these paradigms is critical for leaders evaluating AI adoption paths. This article explores their evolution, real-world use cases, and future trajectories, with a focus on model complexity, explainability, and business value.

Evolution of AI Paradigms

Traditional AI (Symbolic AI)

Traditional AI refers to systems that mimic human reasoning using a set of predefined rules. These systems, popular from the 1960s through the early 2000s, relied heavily on:

- Knowledge bases designed by domain experts.

- Inference engines to perform reasoning.

- Deterministic decision trees and if-then logic.

Example: Early fraud detection systems used hard-coded rules like:

“If transaction amount > $10,000 AND country = Nigeria, then flag for review.”

While interpretable and easy to audit, these systems struggled with:

- Adaptability to new data patterns.

- Complexity scaling in dynamic environments.

Discriminative AI (Machine Learning-Based AI)

Discriminative AI models learn from data to predict outcomes or classify inputs, focusing on P(Y|X) — the probability of output Y given input X.

Key characteristics include:

- Learning from data rather than rules.

- Higher accuracy in prediction tasks.

- Continuous improvement as more data becomes available.

Example: A telecom churn model built using XGBoost can analyze 100+ customer features to predict the likelihood of churn with over 90% precision.

Real-World Industry Use Cases

- Banking and Financial Services

Real Case: Mastercard uses machine learning to detect fraudulent patterns in less than 300 milliseconds per transaction, combining customer behaviour history with external threat intel.

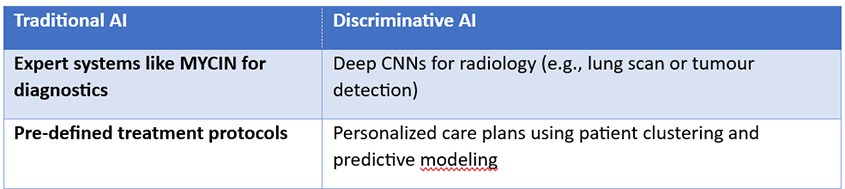

- Healthcare and Life Sciences

Real Case: Google Health’s AI models now assist in diagnosing diabetic retinopathy with accuracy comparable to board-certified ophthalmologists.

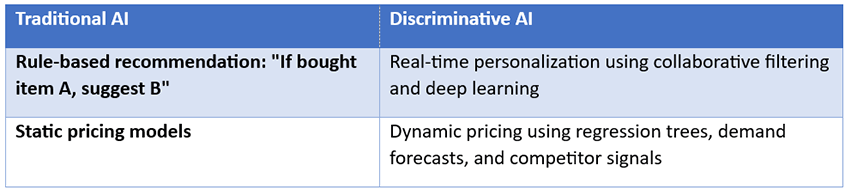

- Retail and E-Commerce

Real Case: Amazon’s recommendation engine uses discriminative algorithms like neural collaborative filtering (NCF) to drive 35% of total revenue.

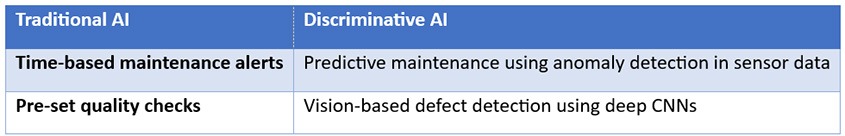

- Manufacturing and Smart Industry

Real Case: General Electric (GE) deploys discriminative AI to predict turbine and jet engine failures, saving millions in unplanned outages

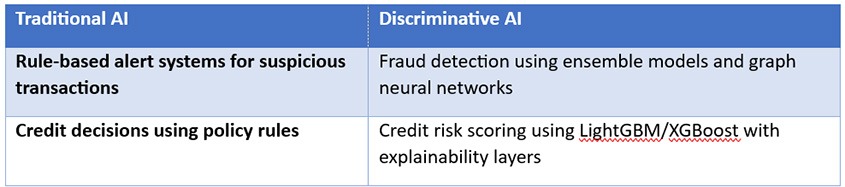

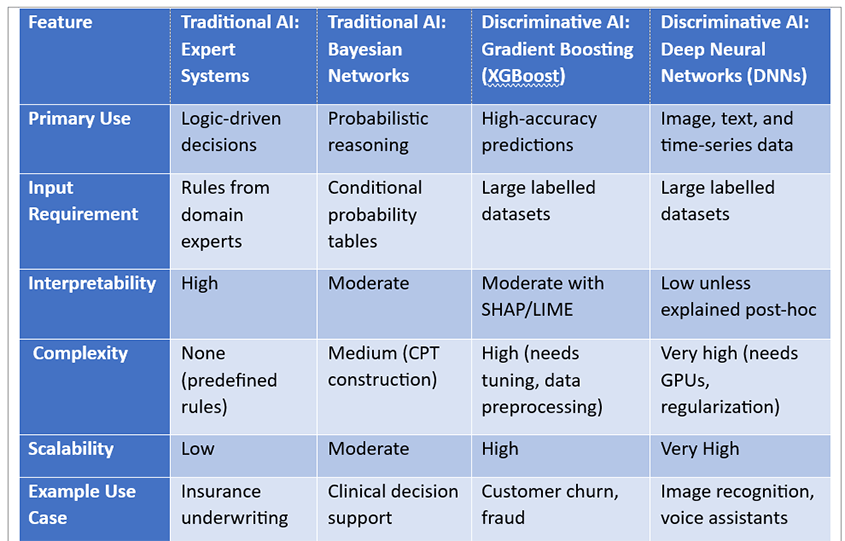

Model Complexity and Comparison

Below is a comparison of two most widely used complex models in each paradigm:

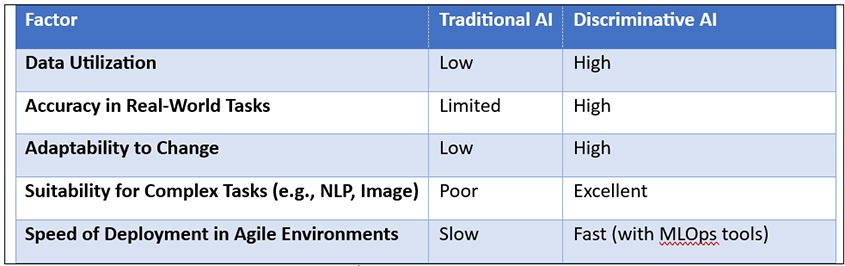

Why Discriminative AI Dominates Today

Today’s digital environments — from banking to healthcare — demand models that learn, adapt, and scale. Discriminative AI meets these demands with architectures that continuously improve as more data becomes available.

The Future: Hybrid AI and Beyond

As we move toward a future of explainable, trustworthy AI, there’s growing momentum to blend symbolic reasoning with statistical learning:

Neuro-symbolic AI: Combines deep learning for perception with symbolic logic for reasoning (e.g., IBM Project Debater).

Explainable ML: Tools like SHAP, LIME, and counterfactual analysis make black-box discriminative models more transparent.

Low-code/No-code AI: Democratizing access through platforms that fuse logic-driven workflows with AI insights.

Closing Thoughts

As the AI landscape continues to evolve, the divide between Traditional and Discriminative AI is no longer one of opposition but of opportunity for convergence. Traditional AI, with its foundations in rule-based reasoning and symbolic logic, offers unmatched transparency and interpretability-essential in domains like legal tech, finance compliance, and healthcare diagnostics where traceability is critical. Discriminative AI, on the other hand, has shown explosive growth due to its ability to learn from massive datasets and deliver high-performance predictions in real-time.

However, neither paradigm alone holds all the answers. In an era where accuracy must coexist with accountability, and speed must align with explainability, the future belongs to organizations that can synergize both approaches. Emerging models such as neuro-symbolic AI and causal learning are paving the way for hybrid intelligence—models that not only predict what will happen but also explain why.

The strategic imperative for industry leaders is clear: embrace the strengths of both worlds. Build AI systems that are not just smart, but also trustworthy, transparent, and aligned with human values. The next frontier in AI is not just about automation—it’s about augmented intelligence that empowers responsible innovation.

References & Further Reading

Gulshan et al. (2016), JAMA. “Deep learning for diabetic retinopathy detection.”

Amazon ML Use Case Study – AWS AI Blog, 2023.

IBM Research on Neuro-symbolic AI

McKinsey Global AI Survey, 2022 – “State of AI Adoption Across Enterprises.”

OpenAI. (2023). “Discriminative vs. Generative Modeling.”

SHAP: Lundberg, S. M., & Lee, S. I. (2017). A Unified Approach to Interpreting Model Predictions.

About the Author:

Consulting Partner – APAC, Risk & Compliance, BFSI Strategic Initiative

Tata Consultancy Services (TCS)

Mr. Abhaya Kant Srivastava is a seasoned Risk Analytics senior leader in banking and financial sector with over 18 years of experience.

Mr. Abhaya Kant Srivastava is currently a Consulting Partner – APAC, Strategic Head Model Risk and Analytics with Tata Consultancy Services (TCS), where he leads the strategic initiative to acquire new projects in the area of risk and compliance analytics and advise clients to deploy advanced statistical and mathematical modelling.

Mr. Abhaya Kant Srivastava, prior to Tata Consultancy Services (TCS), headed a big size team for India Risk Analytics and Data Services Practice at Northern Trust Corporation.

Before Northern Trust Corporation, Mr. Abhaya Kant Srivastava worked at KPMG Global Services, Genpact, EXL and startups like Essex Lake Group and Cognilytics Consulting to lead risk and analytics.

Mr. Abhaya Kant Srivastava is a B.Sc. (Honours) in Statistics – Gold Medallist from Institute of Science – Banaras Hindu University, M.Sc. in Statistics from Indian Institute of Technology, Kanpur and currently doing executive Ph.D. in Statistics/Machine Learning from Indian Institute of Management, Lucknow.

Mr. Abhaya Kant Srivastava, also has a certification in “Artificial Intelligence for Senior Leaders ” from Indian Institute of Management, Bangalore.

Mr. Abhaya Kant Srivastava is Accorded with the following Honors & Awards :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava is Bestowed with the following Licences & Certifications :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava has Led the following Projects :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava can be contacted :

Also read Mr. Abhaya Kant Srivastava‘s earlier article: