AI Assisted Debt Consolidation and Pay off Solution: Retail.

Business Case

The Indian Banking and Finance Industry must introduce reforms in the lending products & services for the retail customers. Introduction of artificial intelligence-based solutions that are developed with robust models to ascertain risk, predict customer behaviour and market fluctuations is the need of the hour.

Banks and Finance companies often provide their commercial and corporate clients with tailor made products & services to manage debts consolidation and restructuring. However, there are no tailor-made solution available for the retail customers to manage their debts and get financial relief. The development of a solution for debt restructuring and retail customers pay-off is the focus of the article.

Problem Statement

Financial mismanagement is a major risk for retail customers. Since the beginning of recorded history there are incidences when people have lost their wealth due to bad financial decisions and mismanagement of both liquid and immovable assets. Also, retail customers when faced with adversities like natural disaster, crop failure, job loss, significant loses to income source due to spread of epidemics, or because of treatment of critical diseases like cancer or kidney failure, lose a lot of money and become dependent on multiple loans.

According to the 2022 study by PwC and Equifax*, smaller ticket size loans such as consumers and personal loans, had the highest rates of Delinquency while Covid outbreak. The higher delinquency among the rural and semi-urban population was attributed to the reduction in household income during lockdowns. The greatest burden of Non-Performing Assets (NPAs) fell upon NBFCs who targeted retail sectors with unsecured personal loans.

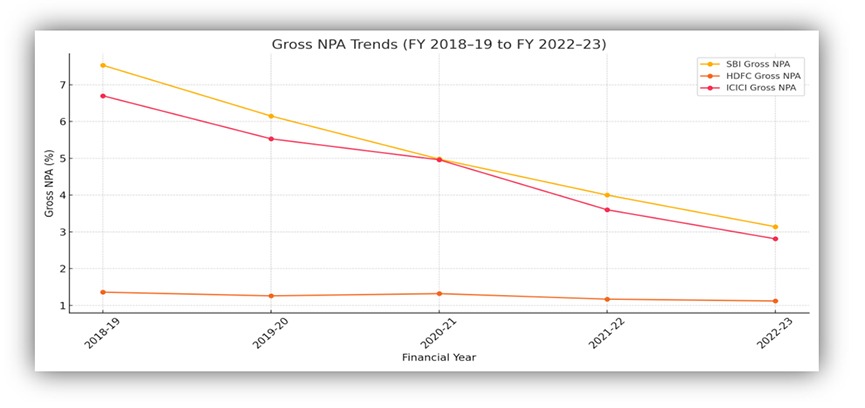

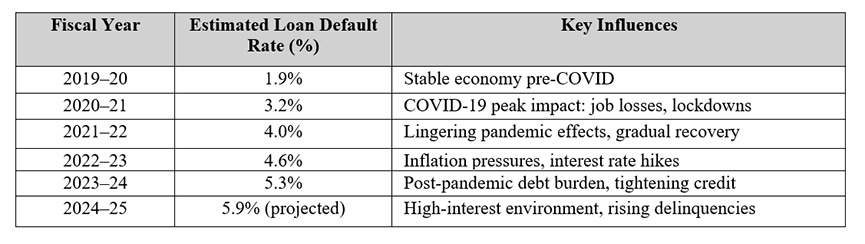

Figure 1.1 Below RBI data also proves a correlation between adversity such as COVID and percentage of NPAs in the retail segment. Due to lock down and job losses at the end of 2018-19, Gross and NPAs were highest in the Financial Year (FY) 2018-19. However, a gradual decline in NPAs was observed with unlock and improvement in market & health conditions and increase in the employment opportunities.

Retail customers initially rely on a single lender but as the situation become more extreme, they become dependent upon multiple loans for survival and attempt to bail out of their financial difficulties. Any mismanagement of funds/misses in EMI payments on account of limited knowledge of financial products, lack of/incorrect financial advice, eventually pushes them in a debt trap. Soon it becomes impossible to keep track of multiple loans, finances and life becomes a hellish experience where one is constantly harassed by threatening phone calls and visits from recovery/collection that the lenders have appointed as well as legal notice sent by their advocates.

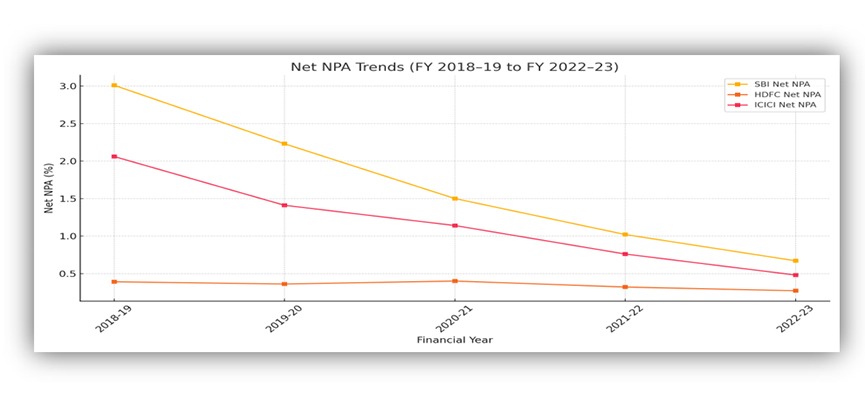

Figure 1.2 Below RBI data shows impact of numerous factors upon growth of NPAs/Loan Defaults.

If the financial situation does not improve, a few retail customers become very distressful and may take desperate measures- start criminal activities, commit suicide, send/sell their women folks to prostitution and more to fulfil financial requirements.

What do retail customers who have failed to manage their debts may be looking for?

Most customers suffering the above-mentioned problem statement are looking for relief from the threatening follow ups for payments through home visits and over phone calls. They want to consolidate their debts by closing all the smaller loans with one single loan which offers them flexibility in terms of release of funds, tenure of payments and interest rates. Possibly rewards or incentives and some financial advice.

Existing financial products that may help retail customers to manage debt issues.

A few solutions for debt managements that are offered to retail customers are listed below for illustrative purposes.

1. Loan Balance Transfer: Help retail customers consolidate their loans; financial organizations offer balance transfer loan products. Idea here is to close multiple smaller loans with single large one. However, this is upselling of personal loans. Such products often fall short of a retail clients need as they do not provide any financial advice on debt restructuring and pay off. Moreover, customer having poor credit bureau scores are not eligible.

2. Payday loans: Payday loans are short-term loans that are having tenures ranging from 7 days to 35 days. These have high processing fees and interest rates, sometimes up to 30%. These are mostly provided by NBFCs and non-regulated lenders. Payday loans require minimum paperwork and are disbursed quickly; hence can be attractive to few retail customers. However, smaller tenure and excessive cost of funds can push customers to debt traps.

3. Gold loans: Gold loans are one of the oldest lending instruments that are useful to people in urgent need of funds. However, inflexible payment schedule and risk of losing the collateral that hold family emotions and sentiments make them not the preferable option for some retail customers.

4. Debt free consultancy services: Few companies provide debt advisory services to both business and retail customers at premium charges. These businesses hire expert financial counsellors and in-house lawyers who may negotiate with creditors on behalf of their clients to manage their debt challenges. The only drawback is that they themselves do not offer any loan/funds, and their solution would mostly depend upon the mercy/discretion of the lenders.

Proposed Solution

A solution that will employ recommendations from an Artificial Intelligence Assisted to ascertain an individual’s financial health and accordingly suggest loan products and customized path for debt relief is the need of the hour. Such a solution can be integrated with the lenders Loan Origination Software to identify, onboard and service retails customers especially those, who are poor in managing finances. The proposed solution should have an intelligence/capability to identify retail customers who have the capacity to payback loans yet are unable to secure debt consolidation due to the lack of financial knowledge and limitations of existing lending products and services.

The regulator should lay down guidelines for private sector, public sector banks and NBFCs to work on tailor made solutions for retail debt consolidation and restructuring.

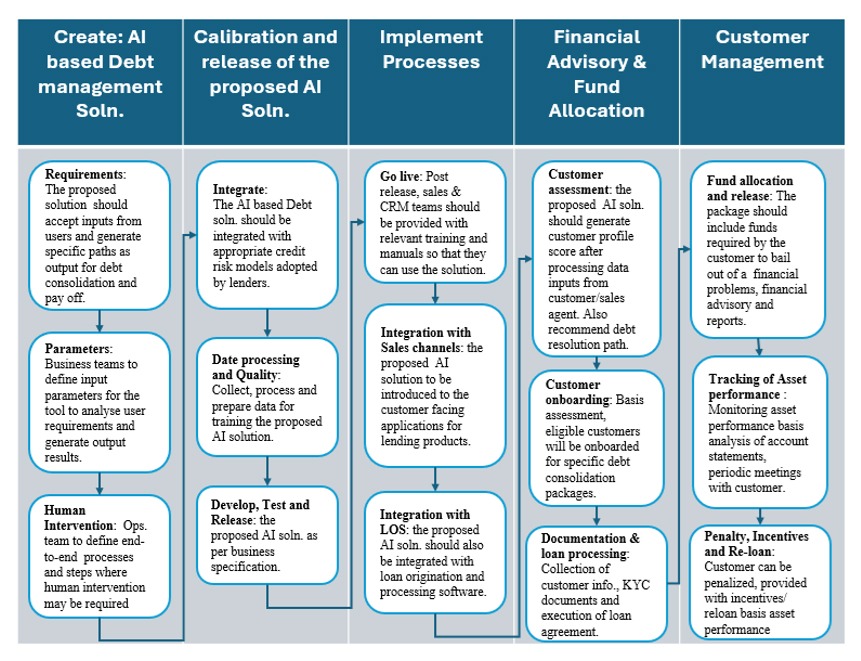

How will such a solution work?

Roadmap: Onboarding & Servicing of debt -ridden retail customers with Artificial Intelligence based Technology solution for Debt consolidation, restructuring and pay off.

Benefit and Incentives

Benefits to the lenders

1. Once this line of business picks up new business opportunities will come to Banks and NBFCs in form of new customer segments or previously unexplored/untapped customer segments. Ensuring steady profits. Retail customers are safer than business and corporate customers because individuals have fixed income and their monthly income and spends can be easily tracked for any risk basis the account statements of their salary accounts.

2. Some of lenders may argue the retail segment would provide them low return but also there is lower risk.

Benefits to the retail customers:

1. They would get qualified advice and get tailor made solution for debt structuring and debt refinancing which was currently not offered to retail customers.

2. Relief from all harassments over the phone calls and home visits instantly.

3. Availability of expert advice from a qualified executive. Therefore, no exposure to fraudulent mobile applications/people/agents who fool customers in pretext of giving cheap loans and disappear with their hard-earned money.

Future Direction

Role of Government and RBI: The debt consolidation service providers should be given benefits by the government and the regulator in terms of low taxes, penalty etc., so that this business be becomes attractive.

Role of NPCI like bodies: Provide scheme/ network to process safe payment towards debts consolidation.

Role of Banks and NBFCs: Develop and market the products for retail debt consolidation.

Conclusion

Implementation of a financial product, which has the capability to ascertain customers credit profile and predict a tailor-made debt restructure plan basis artificial intelligence has become the need of the hour.

About the author:

Mr. Sudhir Kumar Ghosh

Senior Business Analyst – IBM

Mr. Sudhir Kumar Ghosh is seasoned Business Analyst with 16 years of experience in helping Banks and Financial Institutions improve customer experience and engagement through the implementation of innovative digital journeys.

Mr. Sudhir Kumar Ghosh takes interests in conceptualizing technology based financial solutions that can be easily accessible to the less privileged section of the society.

Mr. Sudhir Kumar Ghosh can be contacted at :

Ms. Swati Sharma

Ms. Swati Sharma

Business Analyst – IBM

Ms. Swati Sharma is an experienced Business Analyst specializing in the financial markets sector, with a focus on market intelligence, risk analysis, and financial product strategy. With over 11 years in the investment banking sector.

Ms. Swati Sharma‘s background spans business analysis, solution development, and securities services.

Ms. Swati Sharma is analysing and refining financial processes, products, services, and systems.

Ms. Swati Sharma can be contacted at: