Revolutionizing Capital Markets: The AI-Powered Transformation

Abstract

AI and machine learning are fundamentally transforming capital markets beyond automation across three critical areas: market microstructure analysis, portfolio construction, and advanced risk modelling. Real-world implementations by JPMorgan’s LOXM, BlackRock’s Aladdin, and Morgan Stanley’s Portfolio Risk Platform demonstrate measurable improvements in trade execution, risk assessment, and optimization. These technologies enable real-time processing of vast data and complex market relationship identification, achieving 25-40% performance improvements while managing trillions through AI-enhanced platforms.

Core Applications in Market Operations

Market Microstructure Analysis

Advanced algorithmic systems have become powerful platforms in processing vast quantities of data simultaneously, revealing concealed market behaviours and emerging profit opportunities. JPMorgan Chase exemplifies this technological evolution through their groundbreaking LOXM (Liquidity Optimization Execution Machine), which leverages Azure Machine Learning to optimize client order execution. This intelligent system continuously analyses historical trade patterns while dynamically adjusting to evolving market conditions. The results demonstrate remarkable performance improvements: a 40% reduction in processing time and 25% improvement in successful trade execution, underscoring the transformative impact of AI-driven market analysis on modern trading infrastructure.

Portfolio Construction Evolution

Advanced intelligent systems are revolutionizing portfolio management through three key innovations:

Dynamic Real-Time Rebalancing Unlike conventional portfolio management with predetermined rebalancing schedules, intelligent systems enable continuous optimization. These platforms monitor market volatility, asset correlations, and macroeconomic developments in real-time, automatically adjusting allocations to capture opportunities while minimizing risk. This eliminates human delays and maintains optimal distribution without manual intervention, particularly valuable for evolving markets.

BlackRock’s Aladdin (Asset Liability Debt and Derivative Investment Network) exemplifies this advancement, utilizing machine learning to analyse thousands of portfolios daily. The platform’s growth reflects its effectiveness: investment advisory and administration fees from Aladdin-based assets under management surged from $355.5 million in 2023 to $926.5 million in 2024.

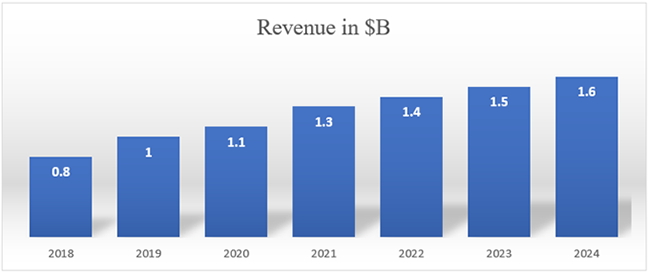

As of 2020, Aladdin oversees more than $21.3 trillion in assets, with technology services revenue reaching a record $1.6 billion in 2024.

Fig 1: Aladdin Technology Services Revenue (2018-2024)

Alternative Data Integration Modern portfolio systems extend beyond conventional financial metrics like earnings reports and price movements, incorporating diverse data sources including satellite imagery, ESG sustainability indicators, consumer transaction patterns, geospatial intelligence, and supply chain analytics. This comprehensive data integration enables AI-driven platforms to identify subtle market trends, consumer behaviour shifts, and geopolitical risks, facilitating more strategic and anticipatory investment decisions.

BlackRock’s Aladdin Climate demonstrates this capability by quantifying climate-related risks and opportunities in financial terms, combining climate science, policy projections, asset information, and financial modelling to generate climate-adjusted valuations and risk assessments.

BlackRock’s Aladdin Climate demonstrates this capability by quantifying climate-related risks and opportunities in financial terms, combining climate science, policy projections, asset information, and financial modelling to generate climate-adjusted valuations and risk assessments.

Personalized Risk Management Intelligent systems customize portfolio strategies based on individual investor characteristics, including risk tolerance, investment objectives, and timeline preferences. These platforms analyse behavioural patterns and financial goals to dynamically modify asset allocations, implement protective hedging strategies, and recommend personalized approaches—whether targeting aggressive growth, steady income generation, or capital preservation.

JPMorgan’s Athena platform illustrates this personalization capability, delivering comprehensive cross-asset risk assessment, pricing, and trade management solutions. The system processes billions of daily risk calculations while achieving a 30% reduction in processing time and approximately 80% decrease in hourly calculation costs.

Risk Modelling Advancement

Modern computational approaches have transformed risk assessment by:

1. Identifying Complex, Non-Linear Relationships Between Market Variables

Traditional linear risk models miss complex market correlations. Advanced machine learning—neural networks and decision trees—captures non-linear relationships conventional models overlook. JPMC’s AI research demonstrates this through risk-sensitive decision trees using reinforcement learning for trade execution, helping investors make better risk-adjusted decisions by understanding underlying price dynamics.

The application of these technologies has achieved impressive results and inspired broader uses of deep neural networks for agent representation in trading applications. Deep Q-trading systems have emerged as effective solutions for algorithmic trading, while LSTM (Long Short-Term Memory) representations of reinforcement learning trading agents have demonstrated significant potential in market applications.

2. Enhancing the Accuracy of Tail Event Predictions

Extreme market events like crashes are difficult to predict using traditional models that inadequately weigh risks. AI-driven deep learning and Bayesian networks improve tail risk forecasting by analysing vast datasets. Morgan Stanley’s Portfolio Platform, combined with BlackRock’s Aladdin Risk Engine, helps foresee potential impacts of market shocks on portfolios.

These advanced systems simulate a wider range of market scenarios, utilizing thousands of potential risk factors to help investors and their financial advisors understand how various risks may affect their holdings, including both internal investments and external positions. Morgan Stanley has further strengthened this capability through their patent (US8370241B1) for systems and methods that utilize probabilistic networks—essentially Bayesian networks—to analyse financial models.

This patented approach enables dynamic modelling of financial variables and their interdependencies, significantly aiding in the assessment of complex risk scenarios and tail events. By incorporating these sophisticated AI-driven techniques, the platform enhances portfolio resilience through proactive risk mitigation strategies, allowing investors to better prepare for and respond to extreme market conditions that could otherwise cause substantial losses.

3. Adapting to Shifts in Market Regimes

Financial markets undergo structural shifts from monetary policy, geopolitical events, or liquidity crises, altering dynamics. Traditional models struggle with real-time adjustment, while intelligent systems use adaptive learning algorithms to detect regime shifts early through pattern recognition.

S&P’s Kensho AI platform NERD identifies 142 million entities—companies, people, organizations, events, places—across market regimes, connecting them to S&P Capital IQ data . This entity recognition monitors multiple information streams simultaneously, providing early warning signals for market changes and enabling dynamic investment strategy recalibration before risks materialize.

AI-driven platforms continuously learn from market data and adapt to regime shifts, unlike static traditional models, ensuring risk strategies remain effective and protecting investors against unexpected transitions.

Conclusion

The next evolution in intelligent financial systems will likely centre on quantum computing integration, federated learning across institutions, and autonomous trading ecosystems that require minimal human intervention. Financial institutions should prioritize three strategic imperatives: investing in scalable cloud infrastructure to handle exponentially growing data volumes, developing cross-functional AI expertise through targeted talent acquisition and training programs, and establishing robust governance frameworks to ensure ethical AI deployment while maintaining regulatory compliance. Organizations that proactively build these capabilities today will be positioned to capitalize on emerging technologies like quantum-enhanced portfolio optimization and real-time regulatory reporting systems.

The organizations that will thrive in this intelligent finance era are those that view AI not merely as a technological upgrade, but as a fundamental reimagining of how financial markets can operate more efficiently, transparently, and effectively for all participants.

The dawn of intelligent financial systems is not a distant future—it is happening now, reshaping capital markets one algorithm at a time.

About the Authors :

Mr. Bhushan Joshi

Mr. Bhushan Joshi

Competency Leader for Banking ISV, Financial Markets and Wealth Management

IBM

Mr. Bhushan Joshi is Competency Leader of Financial Markets and Wealth in IBM India.

Mr. Bhushan Joshi has 25+ years of experience in Driving Business Transformation for clients in Banking, Capital Markets and Wealth Management Industry.

Mr. Bhushan Joshi has played variety of roles including setting up new practices, working with business units and ISV ecosystem partners to drive growth, in program management and working on strategic consulting engagements for CxO level clients at Global Banks in Legacy Modernization with Microservices and Cloud, Business Architecture, Process Strategy and Optimization, Package Implementations, Vendor selection and Innovation.

Mr. Bhushan Joshi Specialties are Consulting, Digital Banking, Capital Markets and Wealth Management

Mr. Bhushan Joshi is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/jo

Mr. Bhushan Joshi can be contacted at:

Mr. Saravanakumar Dinakaran

Senior Managing Consultant

IBM

Mr. Saravanakumar Dinakaran is a Managing Consultant at IBM with over 23

years of experience leading business transformation initiatives across Financial Markets and Investment Banking.

Mr. Saravanakumar Dinakaran brings deep expertise in front-office trading support, risk management, regulatory reporting, and end-to-end business analysis.

Mr. Saravanakumar Dinakaran with strong domain knowledge across all major asset classes—including Equities, Debt, Derivatives, and OTC products—he has successfully partnered with leading global banks and regulatory bodies to deliver complex, high-impact programs.

Mr. Saravanakumar Dinakaran recent work focuses on applying AI-driven capabilities to modernize capital markets, enhance risk controls, and accelerate digital transformation across the financial ecosystem.

Mr. Saravanakumar Dinakaran is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/sa

Mr. Saravanakumar Dinakaran can be contacted at:

References and Sources

https://www.linkedin.com/pulse/ai-powered-trading-financial-revolution-driven-guy-massey-8wole/

https://s24.q4cdn.com/856567660/files/doc_financials/2025/ar/BLK_AR24.pdf

https://www.blackrock.com/aladdin/products/aladdin-climate

https://www.efinancialcareers.com/news/2022/05/jpmorgan-technology-jobs-and-spending

https://patents.google.com/patent/US8370241B1/en