The AI Paradigm Shift Redefining Treasury Fraud : Thought Provoking Shots.

“AI is poised to reshape corporate treasury by enabling greater automation, precision, and insight in forecasting, risk management, and decision-making.”

— Deloitte, “AI and the future of Treasury,” 2023

In January 2008, internal risk teams noticed suspicious trades in French bank, Société Générale. Jérôme Kerviel, mid-level trader in the bank’s Delta One trading desk (derivatives & equity futures), made unauthorized directional bets on European stock market futures. He concealed his true trading exposure by booking fictitious offsetting hedge trades, which were cancelled prior to settlement, thereby bypassing reconciliation and position-monitoring controls. Weaknesses in treasury back-office reconciliation and confirmation controls enabled the manipulation due to bank’s slack internal controls, disconnected front-to-back systems, heavy reliance on human intervention and his insider back-office knowledge to avoid triggering red flags in risk reports. The losses were to the tune of $7bn.

Between 2008-2015 period, Toshiba Corp (Japan), overstated profit exploiting the gaps in treasury monitoring and accounting manipulation. The scandal involves treasury-type mechanisms, like – Revenue recognition manipulation via financing techniques, Misreporting financial health by manipulating cash flow projections and investment returns, and Misuse of hedging and forward contracts to hide losses.

Between 2008-2015 period, Toshiba Corp (Japan), overstated profit exploiting the gaps in treasury monitoring and accounting manipulation. The scandal involves treasury-type mechanisms, like – Revenue recognition manipulation via financing techniques, Misreporting financial health by manipulating cash flow projections and investment returns, and Misuse of hedging and forward contracts to hide losses.

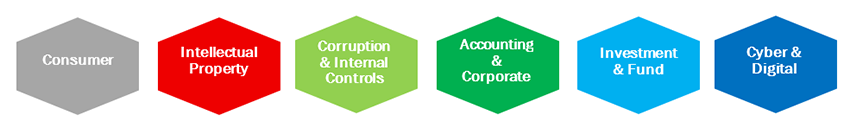

Fraud is omnipotent and omnipresent. This article sheds light on treasury fraud vulnerabilities and demonstrates how AI can transform remediation efforts. The usecases expose vulnerability of treasury department to multi-faceted frauds. Since treasury work together with multiple business unit link to internal and external eco-system, its susceptible to various kind of frauds. The numerous functions of treasury department create entry point for fraudsters to wreck the financial and reputation havoc of an organisation. The lack of user controls, particularly segregation of duties, approval layers, user access controls and undefined irregular audits adds fuel to the fire. We use a looking glass to deep-seek treasury division’s fraud detection and mitigation.

Based on the primary functions of Treasury departments, Frauds of key Treasury function can be bucketed into :

Traditional Fraud Detection

Like Santiago in Hemingway’s novel, most of existing legacy system to detect fraud is like catching the marlin with a fishing rod. Despite being entrenched in most treasury operations, traditional fraud surveillance systems face persistent challenges:

- Rule-based Rigidity – Static, pre-defined logic can’t adapt to emerging fraud typologies.

- High False Positives – Legitimate customer transactions are frequently flagged, impacting CX.

- Manual Dependency – Analysts must continually tune rules to stay relevant.

- Limited Pattern Recognition – Complex, cross-account fraud often escapes detection.

As fraud tactics evolve, these gaps become wider. And the consequences—financial loss, compliance risk, and reputation damage—grow exponentially.

AI – Game Changer

Machine learning doesn’t just find fraud; it predicts and prevents it.” – Forrester Research

AI is growing in depth and coverage and empower Financial Fraud detection and remediation. AI introduces adaptive, context-aware, and predictive capabilities to fraud detection. It not only learns from past events but anticipates future ones—offering a level of foresight that traditional systems simply can’t match.

AI-powered fraud analytics can:

– Detect evolving fraud patterns using deep learning

– Analyze behavior across accounts and channels

– Perform real-time scoring on massive transaction volumes

– Leverage both structured and unstructured data for better insights

This is where AI moves from being a tool to a trusted partner in safeguarding financial integrity.

Thought Provoking Shots: Training AI for Treasury Fraud Resilience

Fraudsters innovate fast, but AI-powered defences innovate faster.

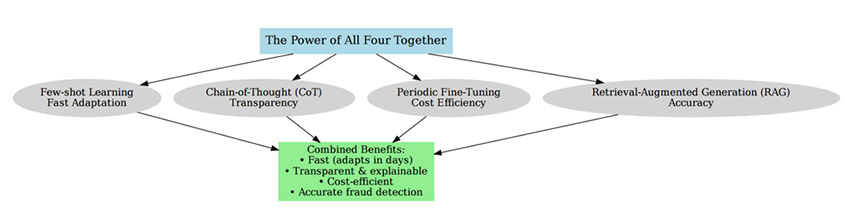

Treasury sits at the junction of high-value flows, privileged access, and fragmented systems—an ideal target for modern fraud. Legacy, rules-based controls catch yesterday’s patterns but struggle with cross-channel schemes and insider abuse. AI changes the physics: few-shot learning adapts to new typologies with minimal labels, CoT makes alerts auditable, RAG grounds decisions in policy and prior cases, and periodic fine-tuning keeps models aligned with shifting behaviour. Combined with strong segregation of duties and model governance, banks can cut false positives, reduce detection latency, and materially lower loss given fraud. Since the AI is continuous learning and improvement, Machine Learning takes centre stage.

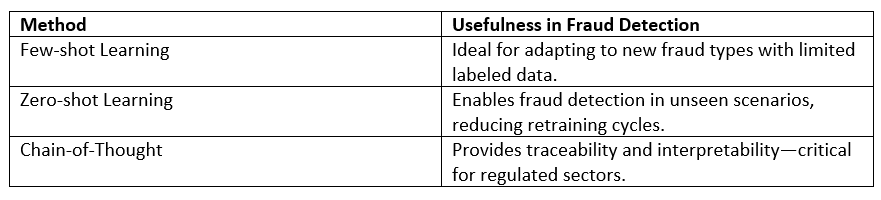

That’s where right adoption is critical. It can be achieved with advanced AI training techniques like Few-shot and Zero-shot Learning, Chain-of-Thought (CoT) reasoning etc.

Why Few-shot Learning + Chain-of-Thought Reasoning is the Best Approach for Financial Fraud Detection?

1. Few-shot Learning for Rapid Adaptation

Fraud tactics rarely stand still. By the time a traditional system is retrained, a new scheme is already in motion. Few-shot learning allows AI to adapt to these shifts quickly, using just a handful of confirmed cases. Few-shot learning enables AI systems to:

- Adapt to new fraud types quickly using a small number of labelled cases.

- Reduce operational cost by avoiding constant large-scale retraining.

Example:

New Scam Pattern in Wire Transfers

- A bank notices a new mule account scam where stolen funds are funnelled through low-balance accounts within minutes.

- By feeding these few examples into the model, along with indicators like transaction velocity, IP patterns, and receiving account behaviour, the system can start spotting similar incidents almost immediately, instead of monthly feedback loop.

2. Chain-of-Thought (CoT) Reasoning for Explainability — Seeing the Why Behind the Flag

One of the biggest frustrations for fraud teams is getting an alert with no explanation. Chain-of-Thought reasoning changes that. It encourages the model to walk through its thinking step-by-step before making a decision — exactly the kind of transparency regulators and analysts expect.

This is essential for:

- Regulatory compliance — Providing a traceable decision process for auditors and regulators.

- Analyst trust — Giving investigators insight into why a transaction was flagged.

- Complex signal integration — Linking signals like geolocation anomalies, device changes, velocity spikes, and unusual transaction behaviour.

Example:

A Chain-of-Thought approach model identifies the transaction as a likely fraud since it traces its origination from a new device, used an IP address in a high-risk region, exceeded typical spending limits, followed multiple failed login attempts, and matched a known high-risk cluster.

3. Periodic Fine-Tuning for Sustained Accuracy — Keeping the Edge Sharp

Even with Few-shot adaptability, periodic fine-tuning is necessary to:

- Incorporate confirmed fraud cases into the core model.

- Address model drift caused by changing customer behaviours and evolving fraud patterns.

- Refresh the underlying detection logic while retaining domain-specific knowledge.

It’s about folding confirmed fraud cases back into the system, correcting any drift, and ensuring the model’s detection logic stays sharp without losing the domain expertise it’s already built.

Recommended cadence: Quarterly fine-tuning with high-quality, labelled datasets.

4. Using RAG for Context without Full Retraining — Smarter Context, Less Guesswork

Retrieval-Augmented Generation (RAG) allows the model to reference trusted external fraud knowledge bases in real time without retraining, which:

- Reduces hallucinations by grounding outputs in verified information.

- Speeds up pattern matching against historical fraud cases and analyst notes.

- Minimizes compute cost by avoiding full model retraining for every new fraud type.

Example:

New Scam Keyword Detection

- Chat logs in a bank’s customer support system contain messages about a “prize redemption” scheme.

- RAG retrieves recent fraud analyst reports describing similar scams and their markers.

- AI uses this retrieved knowledge to immediately detect and warn customers in ongoing conversations — without retraining the full model.

5. The Power of All Four Together – Combined Benefits

Individually, these (Few-shot Learning, CoT Reasoning, Periodic Fine-Tuning, and RAG) techniques are strong. Together, they create a fraud detection system that is:

New Fraud Defence Paradigm – Intelligent, Adaptive & Context-Aware Defence

AI shifts gear from reactive to proactive, intelligent, and integrated fraud risk management—especially relevant in modern treasury operations, where fraud is increasingly sophisticated and fast-evolving.

With fraudsters outsmarting the systems and controls, Fraud possesses challenges best described

– Fraud today is multi-faceted, multi-channel, and adaptive—static rules can’t keep up.

– Few-shot and zero-shot learning unlock rapid response to new fraud methods.

– Chain-of-Thought reasoning brings transparency and traceability to decisions.

– Retrieval-Augmented Generation reduces hallucination and improves auditability.

– KPIs must evolve to reflect both effectiveness and customer sensitivity.

Shot for Thought: The AI-Driven Future of Fraud Risk Management

AI isn’t just a tool—it’s the new teammate reshaping how we think, decide, and act.

AI in fraud detection isn’t just a tech upgrade—it’s a strategic transformation. With a hybrid of Few-shot learning, Chain-of-Thought reasoning, and Retrieval-Augmented Generation, banks and financial institutions can achieve higher detection rates, lower false positives, and greater compliance-readiness.

AI will, henceforth, pitted against the darker side of its mirror ecosystem, which will in a perpetual contest try to outclass each other. In the battle of supremacy and continuous effort to strengthen the citadel of treasury functions, AI is necessity for strategic transformation, and longer a choice. Fraud will keep on mutating to metamorphose from one method to another. Hence, AI-ML with alliance with cloud infrastructure, blockchain, Big Data and Analytics, Social Engineering and data security need to detect and remediate fraud.

Species that thrives are the ones that best adapt to the changing environment. In this is the era of Digital Revolution of adaptability and fusion, nothing adapt like Gen AI.

About the Authors :

Mr. Sudeep Mukherjee

Mr. Sudeep Mukherjee

Senior Industry Consultant – Financial Market,

IBM

Mr. Sudeep Mukherjee is a senior consulting professional working in a renowned technology MNC. Mr. Sudeep Mukherjee has collaborated with global financial services sector firms worldwide. Mukherjee holds Financial Risk Manager (FRM) certification from Global Association of Risk Professional (GARP) and has Master’s degree in business management with specialisation in finance, complimented by Bachelor’s degree in computer science.

Mr. Sudeep Mukherjee has rich experience in digital transformation and strong client relationship leading to enhanced customer experience and value creation.

Mr. Sudeep Mukherjee has front-to-back project implementation experience in Investment & Private Banking, Wealth Management, Fixed Income (Interest Rate Derivatives) and OTC Derivatives, Regulatory and Trade Reporting Services, Credit & Liquidity risk, Data harmonization and Data Migration.

Mr. Sudeep Mukherjee is an evangelist for agile method and devops, thereby bringing changes to projects via continuous improvement and collaboration.

Mr. Sudeep Mukherjee can be contacted at:

Mr. Prasad Naik

Mr. Prasad Naik

Delivery Manager – Complex Programs,

IBM

Mr. Prasad Naik is a AWS Certified seasoned AI Practitioner and delivery leader with over 24 years of experience in global program management, specializing in payments, treasury, and security services within the financial services and insurance (FSI) sector. Mr. Prasad Naik‘s expertise spans AI-augmented program delivery, cloud transformation, and holistic payments solutions across global client locations. Mr. Prasad Naik decorates his career with professional accreditations in PMP®, CSM®, and PRINCE2®.

Mr. Prasad Naik can be contacted at :

Mr. Prasad Naik is bestowed with the following License & Certifications :

https://www.linkedin.com/in/pr