Cyber Security in the Banking Industry : A Critical play

What is Cyber Security in essence?

Cyber security in the banking industry refers to the methods, tools, and technologies used to defend financial organizations, their systems, and clients against online attacks. Among these dangers are ransomware, malware, phishing scams, identity theft, and more. Banks seek to preserve operational health, guard sensitive data, and stop financial losses by putting strong security frameworks in place.

A paradigm shifts in a more cohesive approach that reflects a better understanding and management of cyber threats is anticipated by the cyber security industry. This change pertains to the most recent technological revolution and adoption, as well as related liability, maturity, integration, regulatory, quantification, communication, and behavioural changes. Because of its handling of high-value transactions, sensitive personal data, and cross-border and global reach, the industry is a prime target for cybercriminals, making cybersecurity an essential. Also, digital transformation in banking predictably unleashes plethora of security loops holes. Online banking, mobile apps, APIs, cloud infrastructure, and fintech partnerships have transformed the banking arena, simultaneously expanding the attack surface.

Show me the money!

The sense of urgency is apparent in the world market of cybersecurity. It contributed to USD 172.24 billion in 2023 and is anticipated to raise to USD 562.72 billion by 2032 with a CAGR of 14.3%.

Cybercriminals reap enormous sums from banking-related fraud—measured broadly as the losses suffered by banks, businesses, and consumers. Some numbers to corroborate:

• Global scam & Bank fraud losses: In 2023, worldwide losses from scams and bank-fraud schemes totaled USD 485.6 billion. This figure encompasses everything from authorized-push-payment (APP) fraud and business-email compromise to sophisticated social-engineering attacks.

• U.S. consumer fraud: U.S. consumers reported losses exceeding USD 10 billion to fraud in 2023—the first time that threshold was crossed—according to the Federal Trade Commission

• Internet crime complaints (IC3): The FBI’s Internet Crime Complaint Center (IC3) recorded over 859,000 complaints in 2024, with USD 16 billion in reported losses—a 33% jump from 2023

• Money laundering context: Beyond direct fraud, an estimated USD 800 billion is laundered globally each year—much of it proceeds from various financial-crime schemes, including banking fraud

Lucrative High-Value Targets where banks and their customers hold large sums and sensitive data, low Risk/High Reward where automated tools (bots, credential-stuffing kits), AI-driven phishing, and “money-mule” schemes let attackers scale rapidly. And global reach where Cross-border transactions and diverse regulatory environments make detection and recovery difficult.

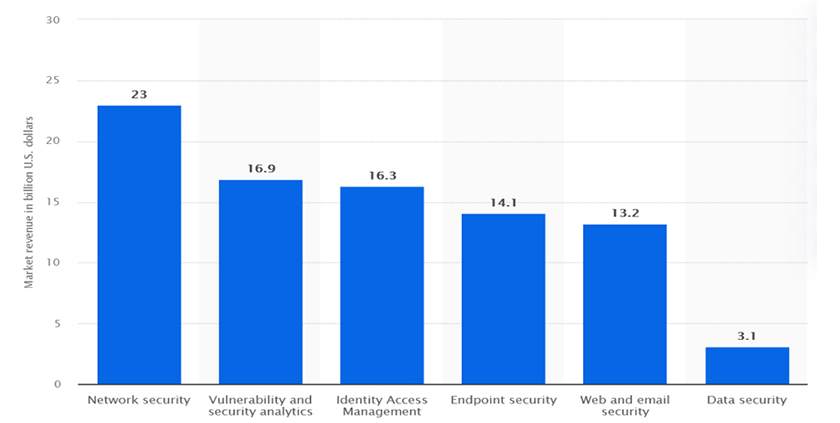

Forecast cybersecurity market revenue worldwide in 2024, by segment (in billion U.S. dollars) (Source: Statista’25)

The flip side of digital transformation

The convenience of digital banking comes with a significant increase in vulnerabilities and security loopholes that cybercriminals are quick to exploit. While the banking sector has embraced digital transformation through online platforms, mobile apps, APIs, cloud infrastructure, and fintech partnerships, this progress has also expanded the attack surface.

The canvas of threat landscape includes some common cyber threats:

- Phishing and Social Engineering Attacks

- Malware and Ransomware

- Advanced Persistent Threats (APTs)

- Distributed Denial of Service (DDoS)

- Insider Threats

- Credential Stuffing and Brute Force Attacks

- Third-Party and Supply Chain Risks

Among these, phishing remains one of the most significant threats. The financial sector is a top target for phishing campaigns that trick employees or customers into revealing sensitive data or downloading malicious software. With the advent of AI-generated phishing content, detection has become more difficult than ever.

Why should Cybersecurity matter?

In the ear of mammoth digital transformation, the importance of cybersecurity in the financial sector cannot be overstated for the following reasons:

• Protects ‘your’ sensitive data: Banks manage vast amounts of customer data—personal details, account numbers, and transaction records. Cybersecurity ensures this data stays protected from unauthorized access.

• Prevents financial loss: Breaches and unauthorized transactions can cost banks and customers millions.

• Regulatory compliance: Institutions must comply with regulations and local banking laws. Compliance avoids penalties and legal action.

• Ensures continuity of service: Attacks like DDoS can disrupt online services. Security systems keep services available and reliable.

• Allows for threat detection & response: Real-time monitoring and threat response capabilities help limit damage during incidents.

• Helps build customer trust: Trust leads to loyalty—lose it, and you risk losing business. Would you trust a bank that compromises your data and puts your money at risk?

The Legal and Regulatory Landscape

According to a Senior Cyber Security consultant from Deloitte: “The biggest deterrent for non-compliance is the financial penalty. But the long-term benefits of a disciplined approach to compliance far outweigh the cost.”

Banks have a legal obligation to safeguard customer information and prevent unauthorized access. Various global and national frameworks guide their cybersecurity efforts:

Global Standards & Frameworks:

• ISO/IEC 27001 provides a risk-based approach to managing sensitive company information.

• NIST Cybersecurity Framework, offers a flexible framework for identifying, protecting against, detecting, responding to, and recovering from cyber threats.

• PCI DSS- PCI Security Standards Council (founded by Visa, MasterCard, etc.)

• SWIFT Customer Security Programme (CSP) enhances cybersecurity across global financial messaging systems.

• DORA (Digital Operational Resilience Act) which focuses on IT risk management, incident reporting, and third-party risk in the financial sector.

Country-Specific Regulations:

• GDPR (EU)

• Gramm-Leach-Bliley Act (USA) requires financial institutions to explain data-sharing practices and safeguard sensitive data.

• FFIEC Guidelines (USA) which help banks assess cybersecurity risk and maturity.

• RBI Guidelines (India) which requires bank to have Cybersecurity Operation Centre (C-SOC)

To stay ahead of threats, banks are adopting advanced technologies:

• Artificial Intelligence & Machine Learning: Used for fraud detection, anomaly detection, and threat intelligence.

• Blockchain & Distributed Ledger Technology (DLT): Offers tamper-proof, secure transaction records.

• Cloud security: Focuses on secure configurations, compliance, and data sovereignty.

• Zero Trust Architecture: Implements a “never trust, always verify” model with micro-segmentation and least-privilege access.

• Cyber Resilience & Business Continuity: Includes backups, insurance, red team/blue team exercises, and crisis communication planning.

Banks and financial institutions are obliged to safeguard sensitive data, ensure compliance. Despite the urgency, banks face several roadblocks, some of the challenges in implementing Cybersecurity are:

• Legacy IT systems that are difficult to secure

• Budget limitations with banks

• A shortage of skilled cybersecurity professionals, cost of hiring specialized skills for the same

• Complex and evolving regulatory environments, hard to come up with

• Balancing customer convenience with strong security controls

According to IBM’s IBV study- research with 1,000 executives across 21 industries and 18 countries (including 140 in banking) reveals a stark reality: banks juggle an average of 114 different security solutions from 42 vendors. This fragmented approach not only frustrates security professionals but also hinders overall effectiveness.

What Are Banks Doing Today?

To combat threats proactively, modern banks are deploying:

- Multi-Factor Authentication (MFA): Enhances security with layers of verification.

- Encryption: Protects data in transit and at rest.

- Security Audits: Regular reviews to detect and fix vulnerabilities.

- AI-Powered Fraud Detection: Identifies abnormal behaviour in real time.

- Secure Payment Gateways: Ensures secure online transactions.

- Employee Cyber Awareness Training: Reduces human error and insider threats.

As cybersecurity continues to be deeply integrated into every aspect of modern banking operations, embedding cybersecurity into every facet of operations, adopting forward-looking strategies, and fostering a culture of vigilance, financial institutions can safeguard their operations, build customer trust and help ensure a resilient financial ecosystem for the future.

While the cyber security file evolves, here are some emerging trends to watch:

• Quantum-Resistant Cryptography: Encryption standards for the era of quantum computing to prevent future vulnerabilities.

• Behavioural Biometrics: Behaviour patterns such as typing speed, mouse movements for continuous authentication.

• RegTech (Regulatory Technology): Leveraging technology to streamline and improve compliance with evolving regulations.

• Cybersecurity-as-a-Service (CSaaS): Outsourcing cybersecurity needs to specialized providers for scalable, expert-led protection. It is a subscription-based model where businesses outsource some or all of their cybersecurity operations to third-party providers. Instead of building and maintaining in-house security infrastructure, organizations can access expert-managed services on demand, often through the cloud. The scalability and flexibility of CSaaS make it an attractive option, a mid-sized regional bank might use CSaaS for managed SIEM (Security Information and Event Management), endpoint detection and response (EDR), regulatory reporting and audits and disaster recovery and business continuity.

According to an independent senior Cyber Security consultant has concerns over data handling- “Customized GenAI Security framework with open ends and no security to protect a bank’s data that is being used is a key concern”.

A continuous strategic imperative

Cybersecurity isn’t an ancillary or support function but a strategic imperative for modern banking. The convergence of technology, compliance, and customer trust demands continuous investment in people, processes, and innovation. It calls for continuous investment in people, processes, and technology is vital to stay ahead of threats.

As banks integrate cybersecurity into every layer of operation and embrace emerging technologies, they move closer to building a future-ready, resilient financial ecosystem. Thus, the future of cybersecurity in banking is poised for transformative advancements that can ensure a resilient financial ecosystem for the future.

IBM as a leader in Cybersecurity

IBM Cybersecurity Services is a trusted partner, delivering advisory, integration and managed security services, to offensive and defensive capabilities, we combine a global team of experts with proprietary and partner technology to co-create tailored security programs to provide vulnerability management and transform security into a business enabler.

Cybersecurity Consulting Services | IBM

IBM NCEE News Room – Case Studies

Security and fraud risks in banking and financial markets | IBM

About the Author:

Ms. Sudha Rawat Talwar is a Senior Consulting professional with a background in marketing and business development.

Ms. Sudha Rawat Talwar is keen on areas such as ESG and hyper personalization in banking and payments. She is based out of Bangalore.

Ms. Sudha Rawat Talwar can be contacted at: