The Role of Open Banking and APIs in Redefining Payments

The payments industry is undergoing a significant transformation. By and large it is driven by rapid technological advancements. However, the key driver behind this is ongoing consumer expectations. This transformation is not limited to a specific sector, most importantly it cuts across the entire ecosystem. It has the volume as starting from retail consumers to large institutional clients, all engage in managing complex financial transactions regularly. As a result of that payment has become an integral part of daily life. It calls for a seamless, secure, and efficient payment infrastructure that can enable delightful experience and enables scale exponentially if required. To address these critical needs, three fundamental aspects have emerged as critical pillars of future payment systems. These are security, usability, and convenience.

This is foremost requirement. As the volume of digital transactions are increasing it needs robust security measures. Fraud prevention, identity verification, biometric authentication, and AI-driven risk assessments are now standard requirements. These are essential to safeguard both retail and institutional customers.

Usability:

Payment platforms must be intuitive and user friendly. Banks are now putting effort to revamp the existing customer journey. This allows clients to process transactions with minimal friction. The need is more on designing the interfaces that cater to all types of users. And the intent is to make their experience delightful regardless of their technical expertise.

Convenience:

Customers now expect instant, hassle-free payments across multiple channels. This can be online, mobile, contactless. Now even emerging technologies like voice-activated payments and wearables are also used to enhance user’s convenience.

Traceability of Transaction:

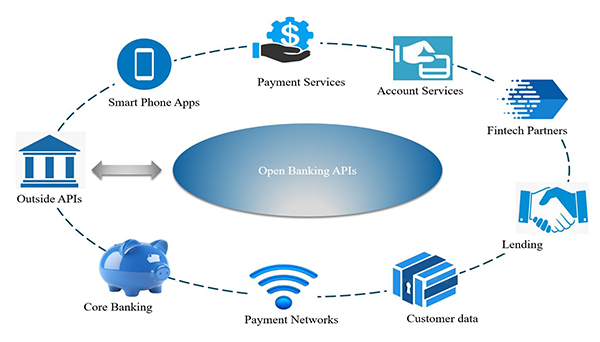

Traceability in open banking ensures that every transaction is recorded, monitored, and auditable. This helps in enhancing security and compliance related issues. Banks and third-party providers use APIs to log transaction details. This helps regulators and customers to track financial activities transparently. This helps in fraud prevention, dispute resolution, and compliance with data protection laws like GDPR and PSD2.

To augment these capabilities, fintech companies are collaborating closely with traditional banks. In a way they are trying to expand service offerings and elevate the overall client experience. This synergy between established financial institutions and fintech is heralding the beginning of more sophisticated solutions. These include embedded finance, real-time payments, decentralized finance (DeFi), and AI powered financial assistants. To sum up payment systems are being redefined to create a faster, safer, and more customer-centric financial ecosystem.

In the paradigm of digital disruptions, Open Banking and API-Driven Payments has evolved as the one of the most emerging systems in the payments domain. Moreover, this takes care of the above three fundamental requirements. It leverages technology to create a decentralized, efficient, and accessible financial ecosystem.

These are secured, enables real time financial data sharing between banks, fintech companies, and third-party providers. Open Banking allows customers to access personalized financial services, by leveraging APIs. This makes the transactions seamless, and the users enjoy greater financial control. They do not have to rely on traditional banking systems. This enhances the convenience of regular and heavy transactions. This innovation fosters competition enhances customer experience. This healthy competition also reduces transaction costs by enabling direct bank-to-bank payments without intermediaries. In addition, Open Banking supports financial inclusion by providing alternative lending and payment solutions. This will be even more productive as and when regulatory framework becomes more sophisticated and data sharing requirements become mandatory. API-driven payments are set to redefine the global financial ecosystem. They are making transactions more efficient, secured, and customer centric in terms of usability.

Some Statistics on existing usage:

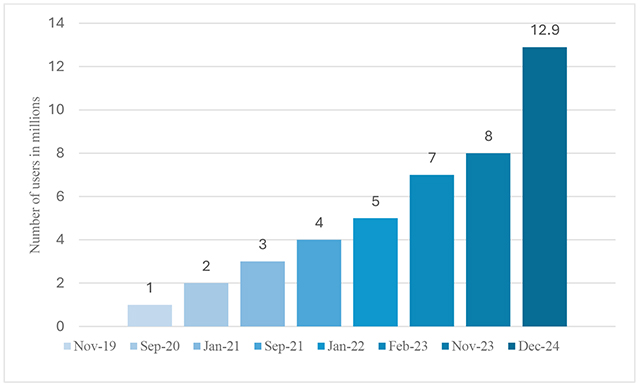

The below chart indicates the gradual increase of Open Banking users. This highlights the growing acceptance and trust in this technology. This steady rise reflects its expanding adoption among both customers and service providers. This is entirely driven by convenience and innovation. As more financial institutions and fintech companies integrate Open Banking, the ecosystem continues to evolve. This trend underscores the transformative impact of Open Banking on the payments and finance industry.

According to a recent Deloitte study, several countries, like India, Japan, Singapore, and South Korea, do not yet have formal or mandatory Open Banking frameworks. However, policymakers in these nations are implementing various initiatives to expedite the adoption of data sharing systems in the banking sector.

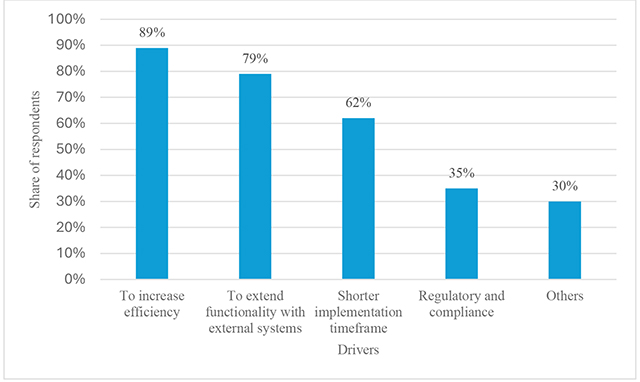

A Statista survey of payment system providers done in 2021 highlighted interesting results. Majority cited efficiencies as the primary motivation for implementing APIs. The report highlighted that efficiency is a key advantage of APIs. This is particularly for its ability to automate data retrieval. Enhanced efficiency invariably increases convenience for the users.

Open Banking and API-driven payments can play a critical role in augmenting Industry 5.0. It enables a seamless financial integration between humans and intelligent systems. As we know Industry 5.0 emphasizes human machine collaboration, hyper-personalization, and sustainability, this Open Banking APIs can provide real-time financial insights. It can automate transactions, and personalize financial solutions customised to businesses and individuals. These technologies enhance supply chain efficiency by enabling instant, frictionless B2B and B2C payments. This also reduces transaction costs and optimizes cash flow. Along with that, AI-driven financial analytics, can make data-driven decisions to improve risk management. Overall, it will enhance customer experience. As the industrial ecosystem moves towards greater automation and human-centric innovation, Open Banking and API-driven payments will serve as key enablers of financial agility, transparency, and sustainability in Industry 5.0.

Call to actions for Industry Leaders:

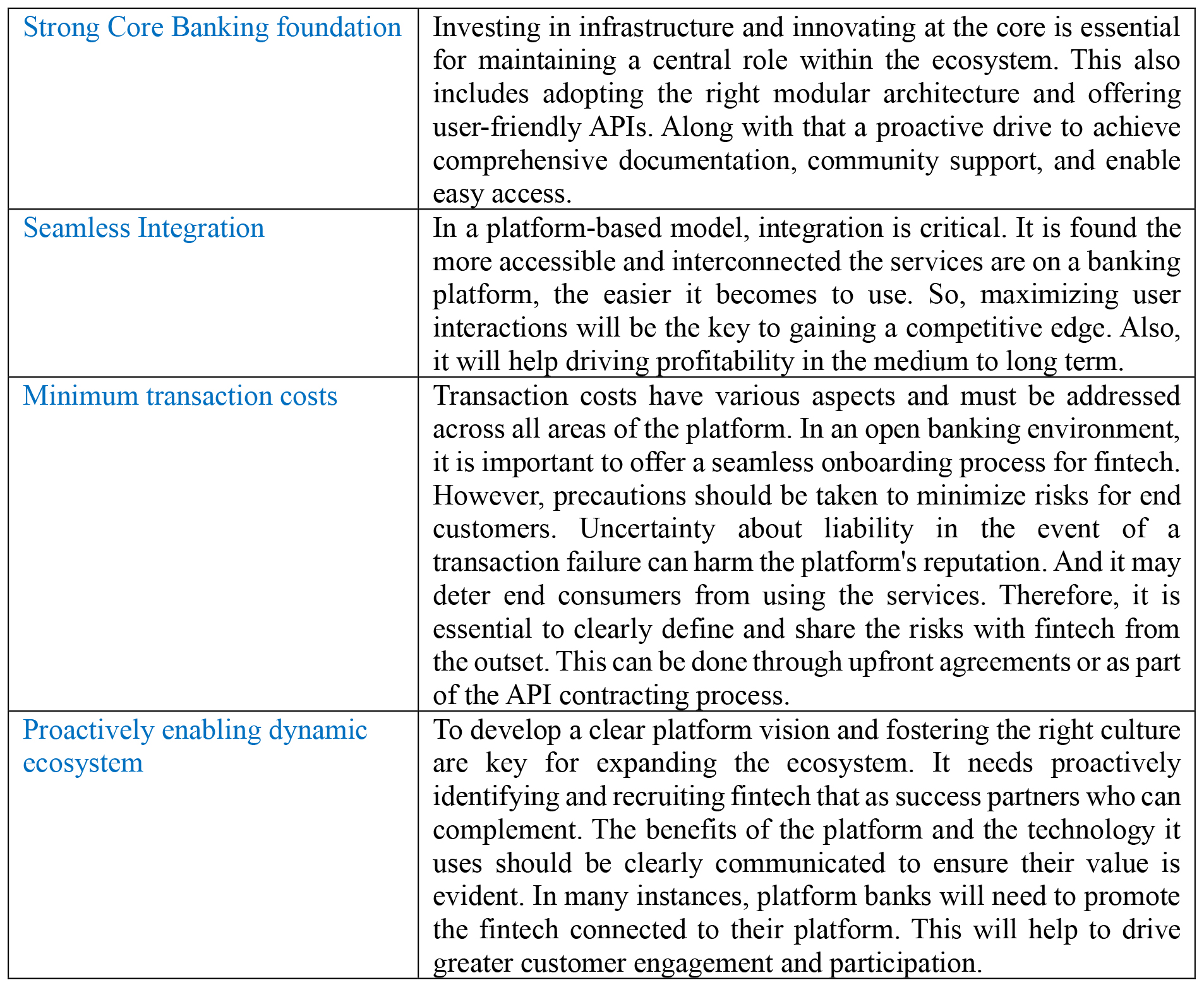

According to Ron Adner in “The Wide Lens: What Successful Innovators See that Others Miss” achieving success requires assessing the interconnections among all partners. It also requires creating strategic plans to navigate these dynamics. He stresses the importance of understanding the roles and power of the various players. At the same time how, their interactions influence the ecosystem.

Conclusion:

Finally, the rapid evolution of the payment ecosystem, driven by innovations such as Open Banking and API-driven solutions, is reshaping how financial services. As platforms become more integrated and user centric, the need for secure, usable and convenient payment systems will continue to grow. Industry leaders must prioritize collaboration, transparency, and proactive engagement with fintech. This will help to foster a dynamic ecosystem that benefits both businesses and consumers. Further it can enable driving greater financial inclusion and improving overall customer experiences in the sustainable, human-centric, and resilient landscape of Industry 5.0.

About the Author :

Mr. Goutam Kumar is a Banking and Payment Industry SME with over 25 years of experience. He works for a leading MNC. In his current role he leads multiple consulting engagements across globe. He is primary into developing business model, business use case, solution roadmap and conducting design thinking workshops. He is also leading Banking and Payment practice in India. He published several white papers and PoVs on Payments and Banking.

Mr. Raja Basu is a Senior Consulting professional in a leading MNC. In his current role he works as a business architect and helps global banking and financial markets clients to enable their digital transformation journey. He has special interest in responsible use of AI and sustainability. He is also pursuing his doctoral studies (PhD) from XLRI Jamshedpur. He is based out of Kolkata, India.

Mr. Raja Basu is a Senior Consulting professional in a leading MNC. In his current role he works as a business architect and helps global banking and financial markets clients to enable their digital transformation journey. He has special interest in responsible use of AI and sustainability. He is also pursuing his doctoral studies (PhD) from XLRI Jamshedpur. He is based out of Kolkata, India.

Mr. Raja Basu is an experienced leader in both technology and business, he has a proven track record of defining and implementing technology-driven transformations for clients in the global banking and financial markets.

Mr. Raja Basu focus lies in automation, particularly artificial intelligence (AI), and its impact on climate and sustainability (SCR).

Mr. Raja Basu possess a deep understanding of value-driven advisory practices, which have played a significant role in building strong client relationships. Throughout his career, he has actively contributed to numerous transformation programs involving complex applications for international clients across the United States, Canada, Europe, and Singapore.

Mr. Raja Basu is Bestowed with the following Licenses & Certifications :

https://www.linkedin.com/in/ba

Mr. Raja Basu is Volunteering in the following International Associations & Institutions :

https://www.linkedin.com/in/ba

Mr. Raja Basu is Accorded with the following Honors & Awards :

https://www.linkedin.com/in/ba

Mr. Raja Basu can be contacted at :

Also read Mr. Raja Basu’s earlier article :