A Comparative Analysis of Basel II, Basel III, and

Basel IV: Regulatory Evolution, Bank Expectations, Modeling Changes and

Reporting Standards

Abstract

The Basel Accords represent a series of regulatory frameworks designed to strengthen financial stability by addressing risks in the banking sector. Basel II, Basel III, and Basel IV each introduced progressive changes to regulatory expectations, capital adequacy, liquidity requirements, and risk management practices. This paper provides an in-depth comparison of Basel II, Basel III, and Basel IV, examining key aspects such as regulatory requirements, the expectations placed on banks, changes in risk modeling, and reporting standards. By analyzing these factors, this paper aims to clarify how the Basel Accords have evolved to enhance financial stability while addressing the complexities of modern banking.

Introduction

The Basel Accords, developed by the Basel Committee on Banking Supervision (BCBS), are designed to improve the banking sector’s ability to absorb shocks and manage risks. Each iteration of the Basel Accords—Basel II, Basel III, and Basel IV—has introduced enhanced requirements to address emerging risks and strengthen global financial stability. While Basel II laid the foundation with its emphasis on risk-sensitive capital requirements, Basel III responded to weaknesses exposed by the 2008 financial crisis, placing greater focus on capital and liquidity requirements. Basel IV, often referred to as Basel III finalization, represents a further refinement, aimed at ensuring consistent implementation across jurisdictions.

This paper provides a comparative analysis of Basel-II, Basel-III, and Basel-IV, highlighting regulatory and bank expectations, modeling changes, and the evolving reporting requirements.

Basel II: A Foundation for Risk-Sensitive Capital Requirements

Basel-II, introduced in 2004, was a landmark development aimed at making banks’ capital requirements more sensitive to the riskiness of their assets. Basel II comprised three main pillars:

1. Pillar 1: Minimum Capital Requirements

Basel II introduced risk-sensitive capital requirements, allowing banks to choose between standardized and advanced methods (e.g., the Internal Ratings-Based (IRB) approach) to calculate credit risk, operational risk, and market risk. This framework enabled banks to determine their capital requirements based on the quality of their loan portfolios and internal risk assessments.

2. Pillar 2: Supervisory Review Process

Pillar 2 emphasized the role of supervisory oversight in ensuring that banks maintained adequate capital beyond the minimum regulatory requirements. Supervisors were tasked with assessing bank-specific risks, including concentration and liquidity risks, and ensuring that banks had robust internal processes for managing these risks.

3. Pillar 3: Market Discipline

Basel II introduced disclosure requirements to improve market discipline by enhancing transparency around banks’ risk exposures and capital adequacy. Through regular disclosures, stakeholders could better understand a bank’s risk profile, promoting sound risk management practices.

Regulatory Expectations and Bank Responses under Basel II

Regulators expected banks to adopt risk-sensitive approaches and robust capital adequacy assessments, encouraging greater transparency and supervisory oversight. However, the flexibility offered by Basel-II’s internal risk models allowed banks some discretion, leading to inconsistent capital levels across banks. This flexibility contributed to the 2008 financial crisis, as underestimation of risk led to inadequate capital buffers.

Basel III: Strengthening Capital and Liquidity Post-Crisis

In response to the financial crisis, Basel-III introduced stricter capital and liquidity requirements to bolster bank resilience. Implemented starting in 2013, Basel III expanded the scope of regulatory requirements across three main areas:

1. Enhanced Capital Requirements

Basel III introduced a stricter definition of capital, emphasizing higher-quality, loss-absorbing common equity Tier 1 (CET1) capital. The minimum CET1 ratio was raised to 4.5%, with an additional capital conservation buffer of 2.5%, bringing the total CET1 requirement to 7%. Additionally, Basel III introduced a countercyclical capital buffer of up to 2.5% to be applied during periods of excessive credit growth.

2. Introduction of Liquidity Standards

Basel III implemented the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) to improve banks’ liquidity positions. The LCR requires banks to hold sufficient high-quality liquid assets (HQLA) to cover 30 days of net cash outflows, while the NSFR mandates that banks maintain stable funding sources over a one-year horizon, promoting resilience against funding shocks.

3. Leverage Ratio Requirement

To limit excessive leverage and complement risk-based capital requirements, Basel III introduced a minimum leverage ratio of 3%, calculated by dividing Tier 1 capital by the bank’s total exposures. This requirement aimed to mitigate the risk of excessive leverage that was prevalent in the lead-up to the crisis.

Bank Expectations and Challenges

Under Basel III, banks were expected to hold significantly more high-quality capital and maintain robust liquidity buffers, adding pressure to their profitability. These requirements led to adjustments in business strategies, as banks worked to meet higher capital standards and improve liquidity management. For many banks, Basel III’s liquidity standards presented operational challenges, requiring substantial investment in liquidity management systems and processes.

Modeling and Reporting Changes in Basel III

Basel III introduced substantial changes to risk modeling, particularly regarding credit risk and capital planning. Banks were required to incorporate stress testing into their capital management practices, modeling various economic scenarios to ensure resilience in adverse conditions. Reporting requirements also expanded, as banks needed to disclose detailed information on capital adequacy, leverage ratios, and liquidity metrics to satisfy heightened market discipline requirements.

Basel IV: Finalizing and Standardizing Regulatory Requirements

Basel IV, often referred to as Basel III finalization, aims to reduce variability in risk-weighted assets (RWAs) by imposing limitations on internal models and enhancing consistency in capital requirements. Key changes under Basel IV include:

1. Standardized Approach Adjustments

Basel IV made significant modifications to the standardized approaches for credit and operational risk to increase their sensitivity and better align them with risk exposure. For example, a standardized floor for RWAs was introduced, capping the extent to which banks can use their internal models to determine capital requirements.

2. Output Floor on RWAs

The output floor requires that a bank’s calculated RWA cannot be less than 72.5% of the standardized approach’s RWA. This requirement curtails excessive variability across banks, ensuring that all banks maintain a minimum level of capital.

3. Operational Risk Framework

Basel IV replaces the advanced measurement approach (AMA) for operational risk with a standardized measurement approach (SMA). The SMA is more transparent and relies on a bank’s income and historical losses to assess operational risk, which reduces reliance on complex internal models.

4. Enhanced Disclosure Requirements

Basel IV mandates additional disclosures for banks using internal models to enhance transparency around risk-weighted assets, model inputs, and capital requirements. These disclosures aim to improve comparability and market discipline by providing stakeholders with a clearer view of a bank’s risk profile.

Bank Expectations and Industry Adaptation

Basel IV presents several challenges for banks, particularly those that rely heavily on internal models. The output floor limits the flexibility of internal risk modeling, potentially leading to increased capital requirements for banks that previously benefited from lower RWAs. Furthermore, the SMA requires banks to revise their operational risk frameworks, necessitating updates to risk management systems.

Modeling and Reporting Evolution under Basel IV

The restrictions placed on internal models in Basel-IV have led to significant changes in risk modeling practices. Banks now need to focus on aligning their internal risk measurements with standardized approaches, which may involve recalibrating existing models. Additionally, Basel IV’s reporting requirements call for enhanced transparency around RWA calculations and capital adequacy metrics, increasing the need for accurate and timely reporting.

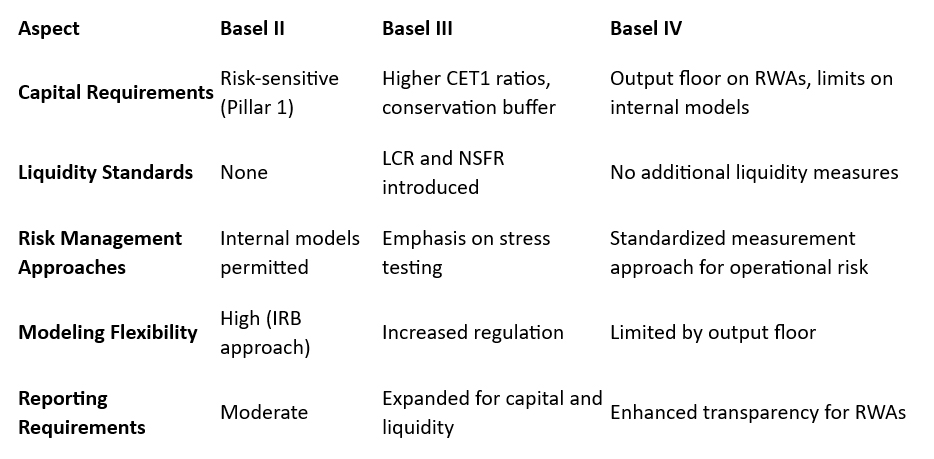

Comparative Analysis: Basel II, Basel III, and Basel IV

Conclusion: The Path Forward: Navigating Basel IV and Beyond

The Basel Accords reflect a continuous evolution aimed at addressing weaknesses in global banking practices. Basel IV, with its emphasis on consistency and transparency, represents a culmination of lessons learned from past crises and regulatory oversights. Moving forward, banks will need to focus on:

1. Enhanced Data Management and Reporting Systems

As reporting requirements become more granular, banks will need sophisticated data management systems to ensure accurate, real-time reporting. This emphasis on transparency requires robust reporting frameworks and technologies to manage complex RWA calculations.

2. Model Governance and Validation

With stricter limitations on internal models, banks must adopt stringent governance frameworks to validate and recalibrate their models in alignment with regulatory expectations. Enhanced governance will ensure that models remain reliable and consistent with the standardized approaches outlined in Basel-IV.

3. Scenario-Based Stress Testing and Risk Forecasting

As regulatory expectations evolve, scenario-based stress testing will remain a critical tool for assessing resilience. Banks must continue refining their stress testing frameworks, integrating economic scenarios and tail risks to validate their capital adequacy in extreme market conditions.

4. Cross-Jurisdictional Compliance and Harmonization

With Basel IV striving for consistency across jurisdictions, global banks face the challenge of aligning their practices to meet varied regulatory

About the Author:

Consulting Partner – APAC, Risk & Compliance, BFSI Strategic Initiative

Tata Consultancy Services (TCS)

Mr. Abhaya Kant Srivastava is a seasoned Risk Analytics senior leader in banking and financial sector with over 18 years of experience.

Mr. Abhaya Kant Srivastava is currently a Consulting Partner – APAC, Strategic Head Model Risk and Analytics with Tata Consultancy Services (TCS), where he leads the strategic initiative to acquire new projects in the area of risk and compliance analytics and advise clients to deploy advanced statistical and mathematical modelling.

Mr. Abhaya Kant Srivastava, prior to Tata Consultancy Services (TCS), headed a big size team for India Risk Analytics and Data Services Practice at Northern Trust Corporation.

Before Northern Trust Corporation, Mr. Abhaya Kant Srivastava worked at KPMG Global Services, Genpact, EXL and startups like Essex Lake Group and Cognilytics Consulting to lead risk and analytics.

Mr. Abhaya Kant Srivastava is a B.Sc. (Honours) in Statistics – Gold Medallist from Institute of Science – Banaras Hindu University, M.Sc. in Statistics from Indian Institute of Technology, Kanpur and currently doing executive Ph.D. in Statistics/Machine Learning from Indian Institute of Management, Lucknow.

Mr. Abhaya Kant Srivastava, also has a certification in “Artificial Intelligence for Senior Leaders ” from Indian Institute of Management, Bangalore.

Mr. Abhaya Kant Srivastava is Accorded with the following Honors & Awards :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava is Bestowed with the following Licences & Certifications :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava has Led the following Projects :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava can be contacted :

Also read Mr. Abhaya Kant Srivastava‘s earlier article: