Top Five Key Risks to Focus on for Strengthening Banks’ Fundamentals and Risk Frameworks: A Chief Risk Officer’s Perspective

Introduction

In today’s rapidly evolving financial landscape, banks face an array of complex and interconnected risks. The role of the Chief Risk Officer (CRO) has become pivotal in identifying, assessing, and managing these risks to safeguard the institution’s stability and growth. With a focus on both immediate threats and long-term resilience, this article outlines the top five risks that CROs should prioritize to strengthen a bank’s fundamental risk framework and ensure its financial soundness.

The recent wave of bank failures has underscored the pivotal role of robust risk management and the necessity of having a dedicated Chief Risk Officer (CRO). A recurring theme in these failures is the absence of a CRO or insufficient focus on top risks, leaving financial institutions vulnerable to cascading threats.

The identified risks encompass both traditional concerns, such as credit and operational risks, and newer challenges posed by technological advances and environmental factors. Addressing these risks proactively can help CROs build a robust, future-ready risk framework that enhances the bank’s resilience in a volatile market.

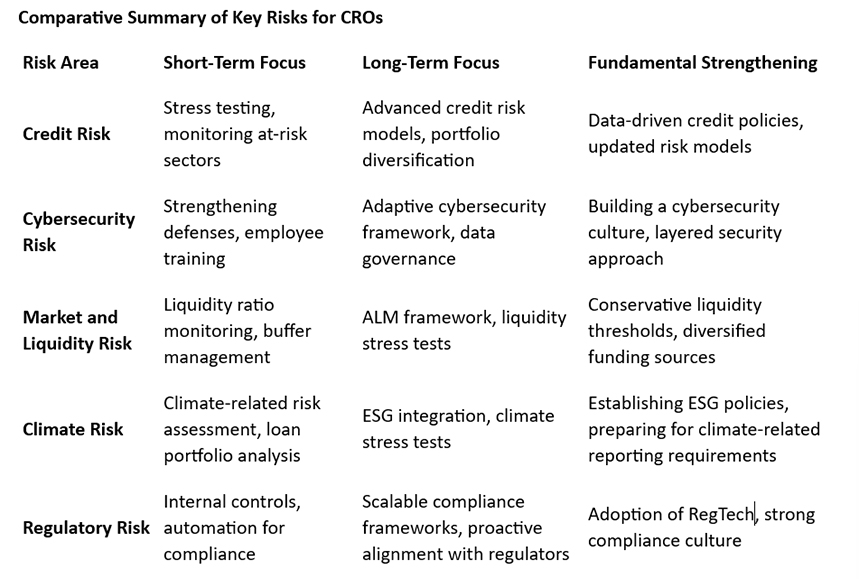

1. Credit Risk

Short-Term Focus:

Credit risk remains a primary area of focus for CROs, especially given the economic uncertainty affecting many borrowers. Rising interest rates, inflation, and economic slowdown can increase loan defaults and impair asset quality. In the short term, CROs should monitor and manage credit risk by conducting regular stress testing, updating credit risk models, and closely monitoring at-risk sectors. Identifying borrowers with deteriorating credit profiles allows for early intervention, such as restructuring debt or revising lending terms.

Long-Term Focus:

In the long run, CROs need to develop frameworks that allow dynamic, data-driven credit assessments and risk ratings. Implementing advanced credit risk models based on machine learning can improve predictive accuracy, helping banks identify potential defaults before they occur. Diversifying the bank’s lending portfolio across industries and regions can also reduce concentration risk and enhance resilience against economic downturns.

Fundamental Strengthening:

Establishing stringent credit policies and maintaining a balanced risk-reward framework are essential. Regular updates to risk models, integrating both macroeconomic and borrower-specific data, can provide more granular insights into creditworthiness. This approach not only minimizes credit losses but also enables the bank to pursue sustainable growth in lending operations.

2. Cybersecurity and Technology Risk

Short-Term Focus:

Cybersecurity threats have intensified, with banks becoming frequent targets for cyberattacks due to the sensitive data they hold and their role in the economy. In the short term, CROs must prioritize strengthening cyber defenses by ensuring robust firewalls, advanced threat detection systems, and regular security audits. Additionally, employee training on cyber hygiene can reduce the risk of phishing attacks and other security breaches.

Long-Term Focus:

In the longer run, CROs need to build a comprehensive cybersecurity framework that adapts to emerging threats. This includes adopting cloud security, enhancing incident response strategies, and ensuring regulatory compliance. As digital transformation accelerates, incorporating cybersecurity into the digital infrastructure will be crucial to protect against cyberattacks. Additionally, CROs should focus on implementing enterprise-wide data governance frameworks that protect customer and institutional data.

Fundamental Strengthening:

Building a strong risk culture around cybersecurity is critical. Integrating cybersecurity into the bank’s overall risk strategy—by embedding it in governance, risk assessment, and monitoring processes—ensures that cybersecurity risks are not managed in isolation but as a core component of risk management. Implementing a layered cybersecurity approach and regularly evaluating potential vulnerabilities will fortify the bank’s defences against cyber threats.

3. Market and Liquidity Risk

Short-Term Focus:

In the short term, volatility in financial markets, driven by factors such as geopolitical tensions, inflation, and interest rate fluctuations, has increased market and liquidity risks. CROs should focus on ensuring the bank’s liquidity buffers are sufficient to withstand sudden market shocks. Real-time monitoring of liquidity ratios, including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), can help identify and manage potential liquidity shortfalls.

Long-Term Focus:

Over the long term, CROs must ensure that the bank’s asset and liability management framework is equipped to handle prolonged periods of market stress. This involves conducting liquidity stress tests under various adverse scenarios, including low-interest-rate environments, currency fluctuations, and market downturns. Diversifying funding sources and building a robust contingency funding plan are essential to maintaining liquidity in adverse market conditions.

Fundamental Strengthening:

A strong liquidity and market risk management framework provides banks with the flexibility to navigate both normal and crisis conditions. By setting conservative liquidity thresholds and developing a proactive approach to managing funding risks, CROs can mitigate the impact of market volatility. Additionally, aligning the bank’s portfolio with its long-term financial goals while ensuring adequate liquidity reserves will enhance its stability and resilience.

4. Climate and Environmental Risk

Short-Term Focus:

With regulatory bodies increasingly focusing on climate risk, banks must assess and manage their exposure to environmental risks. In the short term, CROs should focus on identifying and assessing climate-related risks in the loan portfolio, especially for sectors vulnerable to physical and transition risks. This involves quantifying exposure to climate events, such as floods and hurricanes, and assessing the impact of regulatory changes on carbon-intensive industries.

Long-Term Focus:

CROs need to integrate environmental, social, and governance (ESG) factors into the bank’s risk assessment and decision-making processes. Developing climate risk stress tests and scenario analysis capabilities will be vital to understanding the long-term impact of climate change on the bank’s assets. Collaborating with cross-functional teams to incorporate sustainability into lending practices, product offerings, and investment strategies can further reduce environmental risks.

Fundamental Strengthening:

Building a climate-resilient framework involves setting clear environmental risk policies, establishing ESG committees, and conducting regular assessments of environmental exposures. With climate risk becoming a prominent consideration in regulatory requirements, CROs should ensure that their banks are prepared for future reporting obligations. This proactive stance can also enhance the bank’s reputation and align with investors’ growing preference for ESG-compliant institutions.

5. Regulatory and Compliance Risk

Short-Term Focus:

Regulatory requirements have become more stringent, especially around areas such as capital adequacy, anti-money laundering (AML), and data privacy. In the short term, CROs need to ensure compliance by maintaining strong internal controls, comprehensive compliance training programs, and regular internal audits. Automation tools can streamline compliance processes, helping banks meet regulatory requirements more efficiently.

Long-Term Focus:

CROs must anticipate regulatory changes and align the bank’s practices to be proactive rather than reactive. This involves creating flexible, scalable compliance frameworks that can adapt to evolving regulations. Additionally, embedding a strong compliance culture across all business units is essential to managing compliance risk in the long term. Enhancing communication channels with regulatory authorities can also help the bank stay informed of new requirements and expectations.

Fundamental Strengthening:

Building a robust compliance framework is crucial for maintaining regulatory alignment and managing legal risks. By investing in compliance technology, such as RegTech solutions, CROs can improve the bank’s ability to manage large volumes of regulatory requirements. This focus on compliance helps prevent costly legal penalties, enhances the bank’s reputation, and builds trust with stakeholders.

Conclusion

Conclusion

In today’s volatile financial environment, banks face a multitude of risks, from market fluctuations and cyber threats to regulatory challenges and economic shocks. The CRO serves as the cornerstone of a bank’s risk framework, ensuring that risks are identified, assessed, and mitigated effectively. Without this dedicated leadership, banks are left with fragmented risk oversight, often leading to blind spots in critical areas like above top five risks.

A proactive approach to risk management, focusing on both immediate and long-term risks, is essential for banks to achieve sustainable growth and resilience. The top five risks—credit risk, cybersecurity risk, market and liquidity risk, climate risk, and regulatory compliance risk—highlight the need for comprehensive and adaptable risk frameworks. By addressing these key areas, CROs can strengthen the bank’s risk management capabilities and build a robust foundation for facing future challenges.

About the Author:

Consulting Partner – APAC, Risk & Compliance, BFSI Strategic Initiative

Tata Consultancy Services (TCS)

Mr. Abhaya Kant Srivastava is a seasoned Risk Analytics senior leader in banking and financial sector with over 18 years of experience.

Mr. Abhaya Kant Srivastava is currently a Consulting Partner – APAC, Strategic Head Model Risk and Analytics with Tata Consultancy Services (TCS), where he leads the strategic initiative to acquire new projects in the area of risk and compliance analytics and advise clients to deploy advanced statistical and mathematical modelling.

Mr. Abhaya Kant Srivastava, prior to Tata Consultancy Services (TCS), headed a big size team for India Risk Analytics and Data Services Practice at Northern Trust Corporation.

Before Northern Trust Corporation, Mr. Abhaya Kant Srivastava worked at KPMG Global Services, Genpact, EXL and startups like Essex Lake Group and Cognilytics Consulting to lead risk and analytics.

Mr. Abhaya Kant Srivastava is a B.Sc. (Honours) in Statistics – Gold Medallist from Institute of Science – Banaras Hindu University, M.Sc. in Statistics from Indian Institute of Technology, Kanpur and currently doing executive Ph.D. in Statistics/Machine Learning from Indian Institute of Management, Lucknow.

Mr. Abhaya Kant Srivastava, also has a certification in “Artificial Intelligence for Senior Leaders ” from Indian Institute of Management, Bangalore.

Mr. Abhaya Kant Srivastava is Accorded with the following Honors & Awards :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava is Bestowed with the following Licences & Certifications :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava has Led the following Projects :

https://www.linkedin.com/in/ab

Mr. Abhaya Kant Srivastava can be contacted :

Also read Mr. Abhaya Kant Srivastava‘s earlier article: