Zelle : Revolutionizing Digital Payments

Introduction

In recent decades, the diffusion of digital technology into nearly every business and industries, also known as “digitalization,” has been remaking the U.S. economy and the world of work. Digitization in North America, particularly in the United States, is advancing rapidly.

Zelle was established as clearXchange in 2011 by three large American banks, Bank of America, JPMorgan Chase, and Wells Fargo. It functioned as a digital payments network to facilitate person-to-person (P2P), business-to-consumer (B2C), and government-to-consumer (G2C) transactions. The company was acquired by Early Warning Services in 2016 and re-launched as Zelle in 2017.

Early Warning Services, LLC, (fintech) an innovator in payment and risk management solutions, Zelle makes it easy, fast and safe for money to move. Founded in 2017, Zelle is a digital payment network owned by a consortium of major U.S. banks.

Zelle has revolutionized person-to-person (P2P) payments in the U.S. banking ecosystem. In 2025, Zelle processed $1.92 trillion in transactions—a 20% increase from 2024.

In 2024, it crossed the $1 trillion mark for the first time, with 3.6 billion transactions sent by 151 million users.

In 2023, Zelle handled $806 billion across 2.9 billion transactions, up 28% over-year.

Zelle’s bank-backed model has propelled its user base to 145 million in 2025

What is Zelle?

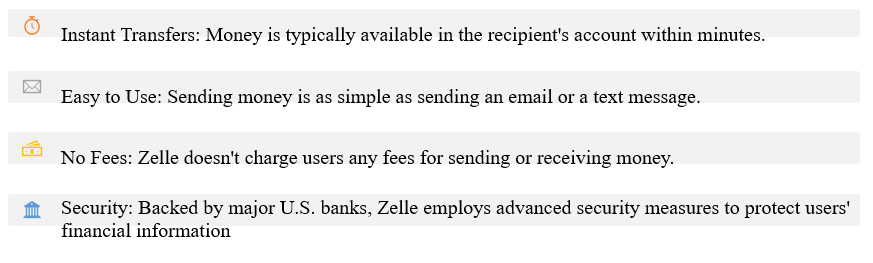

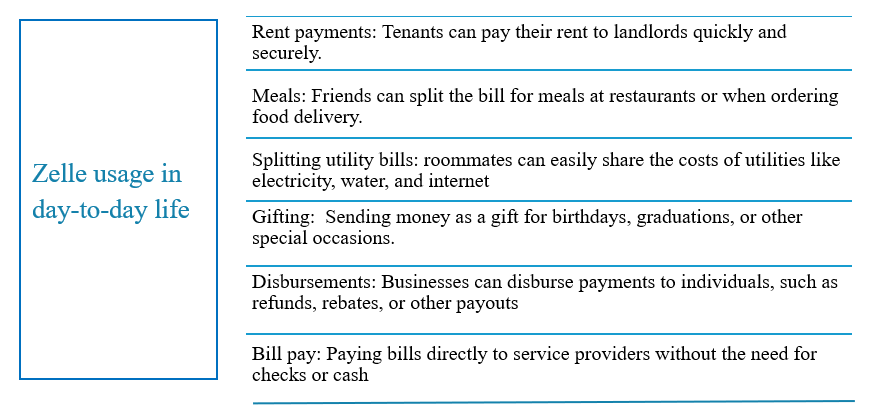

Zelle is a digital payments network that allows users to send money directly from their bank account to another registered user’s bank account within the United States using email address or U.S. mobile number. Users can access Zelle through their mobile banking app or the banking portal. To send money, user need the recipient’s email address or U.S. mobile number. If the recipient is already enrolled with Zelle, the money will go directly into their bank account, typically within minutes. Zelle, is integrated into over 2,000 banking apps, making it widely accessible for users who have accounts with participating bank. In 2018, Zelle introduced the business account function, making it easy for consumers to pay businesses as well.

To use Zelle for your business, the user needs a business bank account. Although Zelle doesn’t offer business-specific features, it is helpful if you’d like to accept and make payments from a business account at a much lower (or no) cost, saving your company unwanted transaction fees.

P2P payments accounted for 52% of Zelle’s total transactions in 2025, maintaining its lead as the most used payment type.

B2B transactions rose 29% in 2025, powered by expanded bank partnerships and business integrations.

Recurring payments grew 22% in 2025, highlighting Zelle’s role in monthly rent, tuition, and bill payments.

Over 91% of users in 2025 rated Zelle as secure and user-friendly.

Fraud concerns remain a challenge, but Zelle has implemented extensive consumer education and security alerts

Zelle Key features

Small Business Zelle adoption

One of Zelle’s biggest strengths is its zero processing fees. Small businesses that are looking for zero-cost payment processing will find Zelle to be highly suitable. Although Zelle does not charge any processing fees, the customer’s bank may charge additional fees for using Zelle. Fast disbursements for services, supplies, or freelance work. Used for recurring expenses like employee wages or rent payments.

Impact

- 7 million+ small businesses enrolled as of 2025

- 35% increase in commercial transactions via Zelle in 2025

- Average payment received: ~$465 Average payment sent: ~$630

Zelle Security features

Bank-Level Encryption: Zelle operates within customer bank app, using the same security protocols as their financial institution

Minimal Info Sharing: Customers need to share an email or U.S. mobile number and not sensitive account numbers. Account details are not exposed.

Authentication & Monitoring: Banks use multi-factor authentication and fraud monitoring to detect suspicious activity

Firewall: Zelle has a firewall that acts as a 24/7 filter. It scans all data that attempts to enter a network and prevents anything suspicious from getting through.

Data encryption: Encryption converts plain text into cipher text within Zelle. This makes it unintelligible or unreadable to anyone who doesn’t have the precise decryption key. Therefore, even if hackers do gain access to a database, users data will not be of any use.

Device security feature: Zelle allows you to enable security features built into your device such as facial or fingerprint recognition.

Enrollment and Customer Trends

• In Q1 2024, one of the leading US banks saw 172,000 new Zelle enrollments, up 11% from the previous quarter. Zelle transaction volume surged 40% over Q1 2023, pushing digital transactions to 76 million

• Younger customers are especially driving adoption: 79% of new accounts come from Millennials and Gen Z, who show higher digital transaction activity

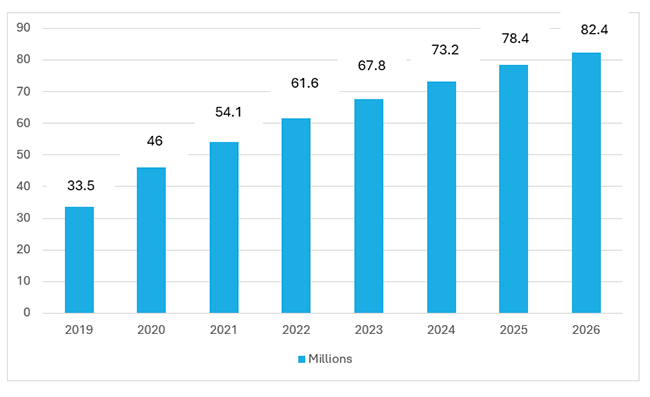

Zelle Growth rate over years

• 2019: 33.5 million users

• 2020: Surged 37.3% to 46 million users

• 2022–2023: Growth slowed slightly to 13.9% and 10.1% respectively

• 2024: Reached 73.2 million users, up 8% from the previous year

• 2025: Expected to hit 78.4 million users, a 7.1% increase by Q4

• 2026: Projected to reach 82.4 million users, growing at 5.1

Zelle and AI

Artificial Intelligence plays a behind-the-scenes but powerful role in enhancing Zelle’s payment ecosystem. AI is mainly used for fraud detection.

Pattern Recognition: Zelle uses AI to spot unusual transaction patterns that may signal fraud. For instance, sudden large amount or number of transfers or activity from unfamiliar devices

Risk Profiling: AI assesses the risk level of email addresses and phone numbers used for transactions, helping banks flag suspicious accounts

Real-Time Alerts: AI enables instant fraud alerts and automated account lockdowns, especially useful for banks facing high scam volumes

Scams are designed to exploit trust and mimic legitimate behavior, which makes them especially challenging for automated systems to detect. Identifying scams relies much more on customer awareness, notifying users with as much information as possible significantly reduces risk. Zelle ultimately rely on a combination of customer vigilance and prevention measures to prevent scams.

Conclusion

• Zelle is a peer-to-peer money transfer service that allows users to transfer money directly to another person’s bank account, often within minutes.

• If financial institution partners with Zelle, customer can typically enroll in the service in banking mobile app using your email address or phone number.

• Customers will be able to send or request money, can also select people from the contact list or add a new person using their phone number or email address.

• Customers could send money to nearly anyone with a U.S. bank account, typically within minutes.

• Zelle has demonstrated how banks can meet evolving consumer expectations with secure, real-time digital payment solutions.

• Zelle continues to outpace its peers. Its bank relationships are a major competitive advantage for its growth, helping it reach a massive network of consumers and businesses.

About the Author :

Ms. Nandhini Balajee

Senior Industry Consultant | QA Lead

IBM

Ms. Nandhini Balajee is a Software Quality Analyst with over 10+ years experience of both web-based and client server Applications in the Banking domain.

Ms. Nandhini Balajee is expertise in understanding and analyzing test requirements, Well acquainted with all phases of SDLC and STLC.

Ms. Nandhini Balajee is experienced in smoke testing, System testing, SIT, Regression and User Acceptance testing.

Ms. Nandhini Balajee is also expertise on testing REST API using SOAP UI and CA DevTest tool.

Ms. Nandhini Balajee can be contacted at:

Reference :

https://www.zellepay.com/press-releases/zelle-soars-806-billion-transaction-volume-28-prior-year

https://www.bankrate.com/banking/checking/how-to-use-zelle-beginners-guide-to-digital-payments/

https://www.brookings.edu/articles/digitalization-and-the-american-workforce/

https://www.pymnts.com/earnings/2023/

https://coinlaw.io/zelle-statistics/

https://www.emarketer.com/content/zelle-growth-tear-1-trillion-volume

https://www.zellepay.com/security

https://paymentcloudinc.com/blog/is-zelle-safe/

https://fitsmallbusiness.com/how-to-use-zelle-for-business/#zelle