Modernizing Fraud Detection with AI

(Real-Time Anomaly Detection and Proactive Threat Prevention)

Executive Summary

Today’s fraud looks different than it did in the past. Since millions of digital payments are made every minute, avoiding fraud is more difficult than simply detecting it. Once reliable, traditional rule-based systems are now too hard to handle the speed and skill of existing fraud. This landscape is being remodelled by artificial intelligence (AI) and machine learning (ML), which provide a more intelligent, immediate, and manageable method of identifying differences as they occur. To avoid fraud in real time rather than counter to it after it has already happened, financial institutions are using artificial intelligence (AI). This article explains why this change is so important for protecting their reputation and customers.

“AI is transforming fraud detection from a reactive safeguard into a proactive defence system.”

1. From Reactive to Proactive Fraud Management

A shady transaction happened, the system flagged it, and an analyst investigated it. This was the simple pattern of fraud management for many years. It was real—until defrauders determined how to beat the system. New attack patterns were too quick for the rules to change. AI flips this strategy on its head. AI learns from real-time data all the time, changing to new behaviors as they happen instead of just using set thresholds.

This means that AI can find patterns like:

✦ Small, well-coordinated transactions that look safe on their own

✦ Trying to log in at strange times or from strange devices

✦ Spending time that doesn’t fit with a client’s usual schedule

2. Real-Time Anomaly Detection: Fast with Smart

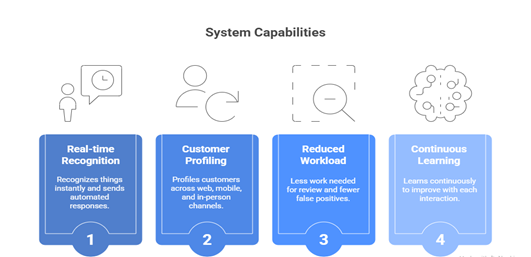

AI-driven fraud systems combine observed and unverified learning to quickly look at huge amounts of transactions. Unverified models discover atypical or infrequent patterns absent prior labelling, whereas observed learning recognizes established fraud categories. Organizations can find risks that they know about and those that they don’t.

Some of the main benefits are:

Some of the main benefits are:

AI systems offer real-time detection, enabling immediate responses to threats. They are scalable, handling large transaction volumes without proportional increases in resources. AI improves accuracy, reducing false positives and enhancing customer trust. Additionally, AI systems lower operational costs by automating fraud detection tasks, freeing human analysts to focus on high-risk cases.

For instance, companies like PayPal have improved real-time fraud detection by 10% using AI, while American Express enhanced fraud detection by 6% with advanced AI models.

Companies that use AI-based detection often get 30–50% more false alerts and respond up to 60% faster, which directly boosts production and customer satisfaction.

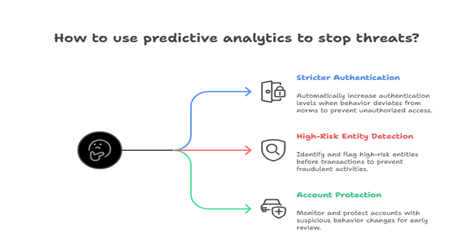

3. Using predictive analytics to stop threats

AI doesn’t just find fraud; it also helps stop it from happening in the first place. Predictive analytics lets systems figure out what debts will happen before they happen. AI immediately changes the level of risk and starts taking steps to stop problems by linking transaction context and behavioural trends.

Example of how to use it:

Using natural language processing (NLP) to find phishing or social engineering attempts and stop them before they can do any harm makes it less likely that known users will need help.

While traditional fraud systems detect incidents after they occur, predictive analytics helps anticipate them. By analysing historical fraud data, seasonal patterns, and user behaviour, predictive models assign risk scores to transactions and entities. Banks and e-commerce companies use these insights to proactively block high-risk activities before they escalate.

Predictive models also change constantly, retraining themselves as new fraud routes surface, making them unique for adaptive fraud prevention across sectors.

“Real-time anomaly detection allows threats to be identified and eliminated in milliseconds rather than hours.”

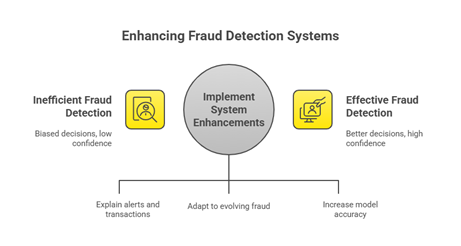

4. Developing a Framework for Adaptive, Transparent AI

AI-powered fraud detection requires the stabilization of automation and accountability. Explainable AI (XAI) offers clarity, enabling agents and regulators to understand the decision-making process.

An adjustable, reasonable model must have the following essential components:

“Thanks to explainable AI, every decision is understood rather than just executed.”

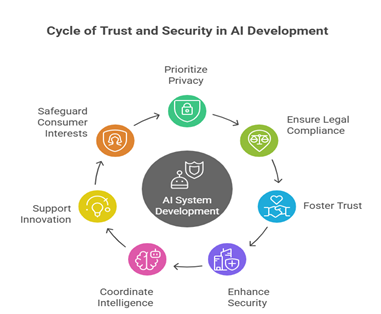

5. Prospects for the Future: Cooperation and Conscientious Innovation

As financial backgrounds develop into established and distributed finance, fraud detection must adapt. In order to enhance detection without losing privacy, the next generation of systems will combine blockchain validation, AI with mutual learning, and reliable data cooperation.

Some latest developments are linked learning models for safe inter-institutional understanding sharing and blockchain-based transaction verification for data integrity.

Future developments in fraud security will be shaped by collaboration and information sharing, which will allow the sector to identify and rule out risks faster than any one organization could alone.

“The future of fraud detection lies in collaborative intelligence and responsible innovation.”

Conclusion

AI has transformed the field of fraud detection into one that is dynamic, intelligent, and active. By using real-time change detection, analytical analytics, and visible decision-making, financial institutions can stay ahead of fast-changing fraud techniques. Technology, human expertise, and data ethics will work together to create a secure and reliable digital.

About the Author :

Ms. Swati Sharma

Ms. Swati Sharma

Senior Industry Consultant – Financial Market,

IBM

Ms. Swati Sharma is an experienced Business Analyst specializing in the financial markets sector, with a focus on market intelligence, risk analysis, and financial product strategy. With over 11+ years in the investment banking sector. Ms. Swati Sharma‘s background spans business analysis, solution development, and securities services. Ms. Swati Sharma is analysing and refining financial processes, products, services and systems.

Ms. Swati Sharma has lead the front-to-back digital transformation of investment banking, securities trading, clearing, settlement & portfolio management platforms.

Ms. Swati Sharma’s area of expertise is capital markets technology modernization.

Ms. Swati Sharma areas of expertise include risk frameworks, regulatory compliance, and using AI, cloud-native architectures, and advanced analytics to streamline processes and open up new revenue streams.

Ms. Swati Sharma is working with investment banks, asset managers, custodians, and fintech companies.

Ms. Swati Sharma assist businesses in future-proofing their business models by striking a balance between client expectations, regulatory requirements and new market opportunities.

Ms. Swati Sharma is Accorded with the following Honors & Awards :

https://www.linkedin.com/in/sw

Ms. Swati Sharma can be contacted at:

Also read Ms. Swati Sharma‘s earlier article: